After last week's improvement, demand in the Turkish hot rolled coil (HRC) spot market has continued at medium levels over the past week. Market sources state that producers in general have been pleased with demand in the second quarter this year, while current demand in the market is also satisfactory prior to Ramadan. Prices in the Turkish HRC market have remained unchanged since last week, while tightness has been observed in availability of HRC due to delays in deliveries by producers.

This year, tightness of availability in the Turkish HRC market, which was an insignificant problem when it first emerged due to overhaul work in April, has occasionally become a serious problem over past months due to delayed deliveries. Traders state that the problem still exists, with stocks at low levels in the market, and so the smallest delays lead to tight availability.

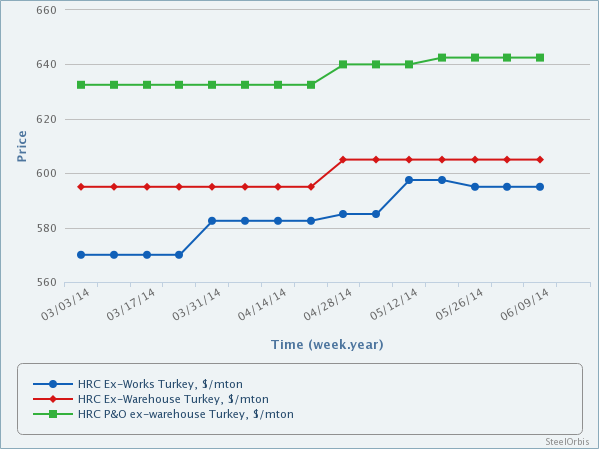

Producers' prices in the Turkish HRC market have also remained unchanged since last week. Producers have filled their order books for July and started their sales for August. Market sources indicate that, despite the softening of iron ore prices, Turkish producers' HRC prices have remained firm with the support of high scrap prices and the improvement in demand in the Turkish domestic HRC market compared to previous quarters.

Producers' HRC prices have remained in the range of $590-605/mt mt, while discounts are available to certain buyers and depending on tonnages.

The domestic sales prices of traders for local and imported hot rolled flat steel products in the Eregli and Gebze regions of Turkey are as follows:

Product | Price ($/mt) | |

Eregli | Gebze | |

2-12 mm HRC | 600-610 | 605-615 |

2-12 mm HRC (for large volume sales) | 590-600 | |

1.5 mm HRS | 630-640 | 635-645 |

3-12 mm HR P&O | 635-640 | 645-650 |

The above prices are ex-warehouse and for advance payments, exclusive of 18 percent VAT.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.