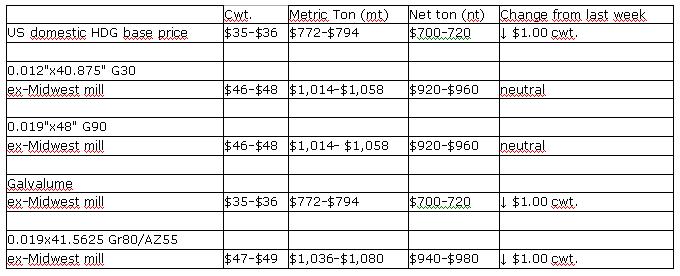

The US domestic hot dipped galvanized (HDG) market has maintained its continued softening trend, with an additional $1.00 cwt. ($22/mt or $20/nt) price softening seen for HDG base, Galvalume, and Galvalume 0.019x41.5625 Gr80/AZ55. As reported previously, deals below average transaction prices may be available "depending on the day and the direction the wind is blowing", specifically in regard to coating extras, as buyers seem to get quoted different prices regularly.

US automakers GM, Ford and Chrysler have all reported a month-on-month decline in sales from May to June, and according to a July 1 report by the US Census Bureau of the Department of Commerce, construction spending for the month of May fell short of previously forecasted expectations. Further, the US department of Labor, Bureau of Labor Statistics reported that the unemployment rate for June, while down 0.2 percent from May, was still at 9.5 percent, with 14.6 million Americans still without jobs. The bottom line is that economic factors are still having a major impact for key segments of coated steel products, and prices will thus continue their downtick until market conditions improve, or unless mills decide to drastically curb production.

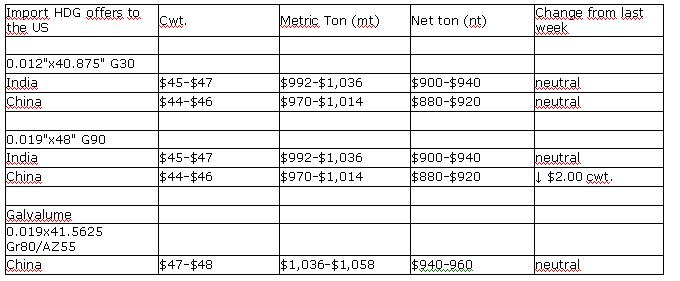

Looking to imports, both India and China have remained relatively neutral on their offerings since our last report a week ago, although a $2.00 cwt. ($44/mt or $40/nt) softening has been seen for Chinese HDG 0.019"x48" G90, bringing pricing down to their offering range for HDG 0.012"x40.875" G30. It should be noted, though, that revised pricing for imports of these products out of both countries is expected to be announced within the next week. Offerings listed below are all FOB loaded truck, US Gulf ports.