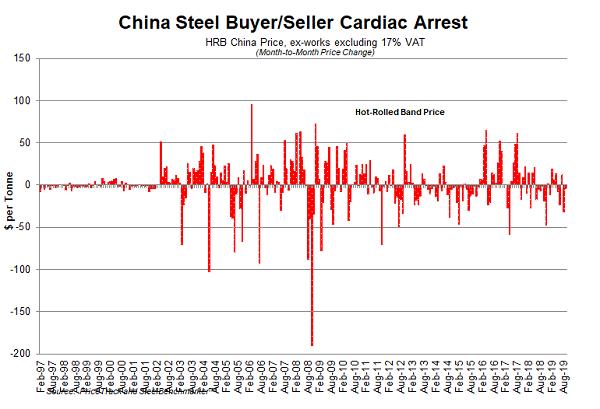

The HRB export price in late 2015 was, by far, the lowest in the history of the industry relative to the steel mills’ costs – i.e., it was about $50 per tonne below the marginal cost of the median-cost steel mill delivered to the port of export. This calamitous price/cost situation stimulated an avalanche of steel trade suits against the Chinese steel mills and others. By the Fall of 2018, the trade suits had multiplied to such an extent that the steel industry was pushed into a new “Age of Protectionism.”

Since then, there have been continued trade suit actions in many countries. Yet, there’s been no diminishment in international steel mills’ exporting potential – in fact, it’s probably up.

Global steel exports in 2017 were about 455 million tonnes, including about 110 million tonnes of intra-EU trade. The EU steel marketplace is a competitive market because so many foreign mills – including those in Eastern Europe, Russia, Ukraine, Turkey, China and elsewhere – are seeking a share of it. Often, the HRB spot price in the Southern European region is not far above the HRB World export price.

Apart from the steel mills’ shipments of steel products to their downstream fabricating and manufacturing plants located in other countries, perhaps two-thirds of exports of other steel products are subject to considerable price competition. Safe havens are few.

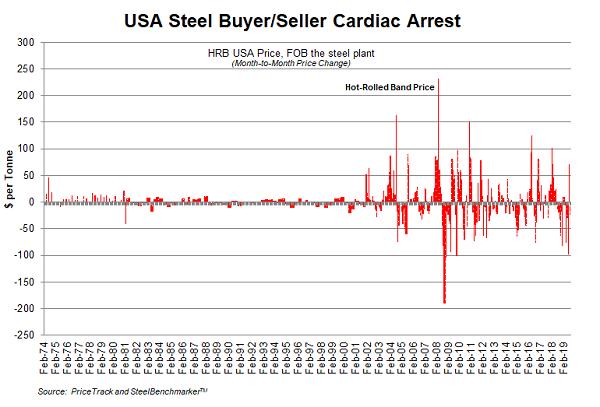

In the USA, Section-232 trade restrictions implemented initially in mid-March 2018 did not drive down foreign deliveries as much as expected. In the following months, USA prices rose to a huge premium to foreign prices. Hot-rolled band in the USA in July 2018 peaked slightly above $1,000 per metric tonne versus the HRB export price at that time of $600 per tonne, FOB the port of export.

In the Pacific Basin, a sizable number of new coastal mega-sized steel plants have come into production since 2008. And, many more are planned. In China, at least 10 plants have been started up fairly recently and/or are under construction. In Indonesia, there’s a relatively new partially-POSCO-owned integrated plant. In Vietnam, Formosa Plastics is operating a second blast furnace at its new 7 million-tonne-per-year Ha Tinh unit; and, another mega steel plant, owned by the Hao Phat Group, is just starting up an integrated 5+ million tonne per year facility. A new mega-plant has been announced for the Philippines.

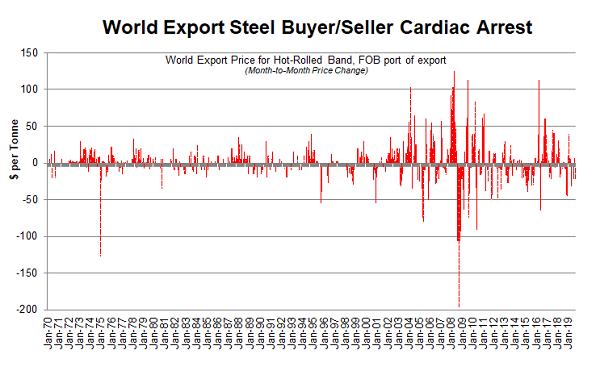

Hence, we no longer think that a pricing “death spiral” for HRB in the world market can be expected every 10-15 years. Now, each time there’s a significant downturn of apparent steel demand, or perhaps two to three times per decade, a pricing “death spiral” may occur.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2019 by World Steel Dynamics Inc. all rights reserved