European Situation – Is an “Economic Renaissance” now possible?

Under threat from a USA driven geopolitical de-coupling – specifically as it pertains to defense and, to a lesser extent merchandise trade – European policymakers have unexpectedly sprung into action. The most dramatic action to date has been the de facto abandonment of the self-imposed “debt ceiling” by the German government and a pivot toward aggressive deficit spending plans, primarily aimed at boosting defense and improving the country’s ageing infrastructure in the years ahead. These actions appear to be stoking broader optimism that EU governments may now be changing tack to a more aggressive course of de-regulation and investment in the years ahead, potentially leading to an eventual end to the region’s seemingly perpetual state of economic stagnation – something that appeared virtually unfathomable only a few months ago.

From a steel industry-specific perspective, the surprise March 19th announcement of the “European Steel and Metals Action Plan” appears to have also inspired a measure of market optimism. As a “declarative” document it does not contain specific measures; rather, it provides a general framework of the European Commission’s policies and plans for the coming year:

- The current safeguard system will be replaced by another tool from January 2026. The new system “design” will be presented in Q3, with the aim of ensuring “long-term market protection. WSD take: Naturally, any such change will have a significant impact on prices.

- No later than Q3 “The Commission will consider trade measures to ensure sufficient availability of scrap.” WSD take: Should significant measures be taken to reduce EU scrap exports, domestic EU scrap prices could decline all the while international prices rise as supply tightens.

- The Commission announced a "melted & poured" rule to limit trans-shipped imports. WSD take: In our view, this will not have a significant immediate impact on the market, as such a mechanism is difficult to enforce.

- A “threat of injury” rule was also announced, which could allow anti-dumping investigations to be initiated without actual damage but rather based on risk assessment. WSD take: This is a potentially powerful restriction that could be aimed at price monitoring. Exporters to the EU would need to be careful to avoid significant discounts in their offers to European customers going forward.

- CBAM is expected to expand to downstream products, which has been a topic of discussion for a long time. In the long-run, this has the potential of significantly reducing “indirect” steel-containing goods imports thereby supporting domestic EU steel consumption.

- The European Commission essentially “blessed” energy subsidies by any means possible via the European Energy legislation and State Aid rules.

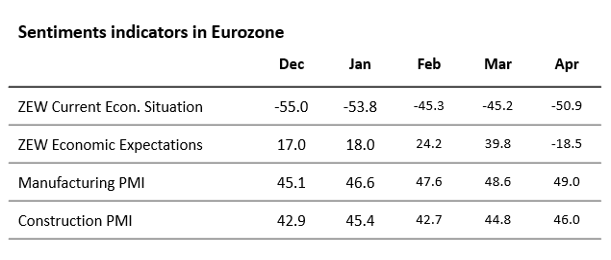

Besides the “Steel Action Plan,” European business is apparently inspired by the prospects of an array of other recent government actions, including: the aforementioned €500B infrastructure fund in Germany, the EU Automotive Action Plan, the ReArm Europe Plan for the defense sector, and the European Steel and Metals Action Plan. Sentiment surveys are reflecting these recent “green shoots” of optimism, with Eurozone economic sentiment surging. The ZEW Business expectations index was up 15.6 points to 39.8 points, well above the average of 12 points in March and Manufacturing and Construction PMI up to 49 and 46 in April.

Source: ZEW, Reuters, GMK, S&P Global

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non -public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright Ó 2025 by World Steel Dynamics Inc. all rights reserved