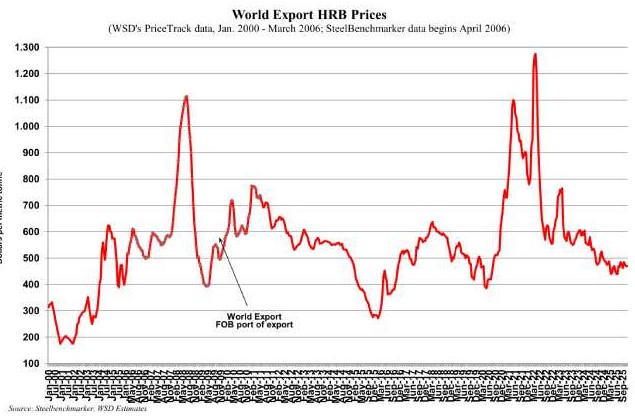

Looking back for guidance regarding what happened in late 2015 – the time of the last historical HRB export pricing death spiral – may not be a good proxy for what follows in the near future.

- Over the course of roughly 12 months, beginning late-2014, the HRB export price declined from about $500 per tonne, FOB port of export, to ~$275 per tonne in December 2015. During that period, China’s steel exports rose from an annualized rate of 114 million tonnes to 120 million tonnes.

- The “bottom” of the market, ranging from $272 per tonne to ~$299 per tonne, lasted about six months with the price beginning to rebound in April 2016 surging to ~$450 per tonne by May. China’s export rate averaged about 115 million tonnes annualized during that period.

- After various “ups and downs” through the summer of 2016, the price eventually picked up steam into the end of 2016 to $500+ per tonne. From April through the end of 2016, China’s steel exports would gradually decline to about 87 million tonnes annualized, a reduction of about 41 million tonnes from the peak rate of 128 million tonnes.

Unlike the situation in 2015-2016, there appears to be no meaningful reversal in sight to China’s steel exports:

- China’s exports have averaged about 137 million annualized to date in 2025, following an average figure of 124 million tonnes for all of 2024. The latest figure for October 2025, at 11.9 million tonnes (inclusive of semis exports and yielded-up to a crude steel equivalent basis) still translates to ~140 million tonnes annualized.

Given the absence of any evidence supporting a sustained reversal in this trend, especially given the macro-policy signals from the recently concluded Fourth Plenum (more on this in the China section), WSD sees little reason to expect the HRB export price to break out of its recent “floor” in the $440-480 per tonne range until perhaps late-Q1 or Q2 of 2026. Even so, the upside to the price is likely to be limited with a figure of $500-510 per tonne representing the near-term “peak” in this scenario.

- More outlays for machines using AI to replace workers. Capital is replacing labor.

- High fixed asset investment (construction and capital spending) in many countries because policymakers are fearful of diminished employment based on the use of artificial intelligence. They promote FAI to create more jobs. The Capital Fundamentalism economic theory is in full bloom.

- High returns on manufacturing investment based on opportunities created by the technological revolution and the low cost of money.

- No runaway in the prices for industrial commodities – including steelmakers’ raw materials and, possibly, oil.

- No runaway wage increases. Workers are losing their pricing power as capital continues to replace labor. Workers are increasingly fungible.

Some economic growth restraints – the countervailing forces – include:

- Aging populations.

- Political turmoil.

- Massive municipal and governmental debt in a number of countries, leaving less funds for infrastructure spending.

- Trade wars.

- Individual country economic flare-ups.

- The Chinese economy may perform more poorly than expected.

- Destabilizing swings in exchange rates.

- Stock market declines.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non -public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright Ó 2025 by World Steel Dynamics Inc. all rights reserved