European Steel

In March 15, 2022, the EU and G7 partners including the UK announced a new sanctions package against the Russian federation amid the ongoing invasion of Ukraine. The scope of the new sanctions includes the ban of imports of iron and steel products (excluding semi-finished products) from the Russian federation.

The conflict in Ukraine has caused a big impact on energy prices around the world, causing skyrocketing oil and natural gas prices. The Brent crude oil price soared to a high of $127 per barrel from an average of $94 in February. The price has since held steady at about $100-110 per barrel.

As oil price hikes have dominated headlines across the world, steel was also heavily impacted as supply was cut off from Russia and Ukraine because of the war. Steel, being a foundation of the modern economy, is a key commodity in a slew of applications from bridges, skyscrapers, to automobiles and household appliances. The prices of steel have also hit record highs globally, especially in Europe.

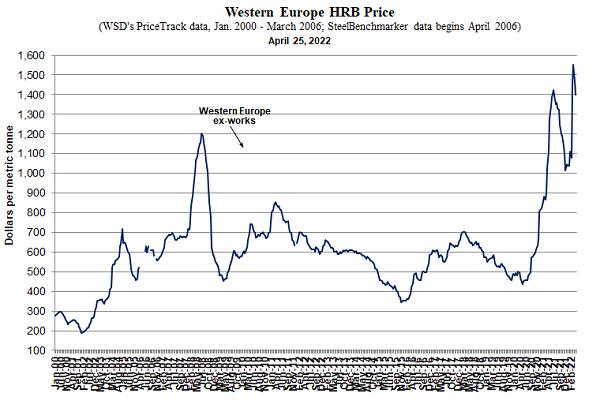

The HRB price in Europe hit a high of about $1,550 per tonne in late March immediately after the invasion broke out from about $1,040 per tonne in January 2022. It has remained high at about $1,450 in the last month but has eased to about $1,300 in early May.

The rise in European prices has been exacerbated by the disruption in supply of steel brought about by the ban of steel imports from Russia, which accounted for about 12.8% (16% increase from 2020) of the EU’s finished steel imports in 2021. Ukraine all but halted their steel production due to the ongoing conflict, with ArcelorMittal and Metinvest among those affected by the war which intensified the steel supply glut in Europe. Steel imports from Ukraine made up about 8.77% (111% rise from 2020) of Europe’s finished steel imports in 2021.

| Finished Steel Products Imports into the E.U. | |||||||||||

| (million metric tonnes) | |||||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Russia | 2.14 | 2.46 | 2.71 | 2.77 | 3.49 | 3.54 | 2.40 | 3.70 | 3.04 | 3.21 | 3.73 |

| Ukraine | 4.17 | 2.72 | 3.01 | 4.51 | 6.90 | 5.67 | 3.44 | 2.83 | 2.41 | 1.21 | 2.54 |

| Total Imports | 19.86 | 13.83 | 15.81 | 18.75 | 23.78 | 26.19 | 26.12 | 29.28 | 25.37 | 21.18 | 28.99 |

| % share | 31.80 | 37.41 | 36.18 | 38.78 | 43.69 | 35.15 | 22.38 | 22.29 | 21.46 | 20.87 | 21.65 |

| Source: Eurofer, WSD Estimates | |||||||||||

The question that needs to be answered now is: how to offset the supply gap left by Russia and Ukraine? Europe could possibly increase their own production, but it is constrained by raw material shortages and high costs of energy and carbon. China, India, Turkey and Southeast Asia have already begun to fill the gap, but not without some challenges.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non -public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2022 by World Steel Dynamics Inc. all rights reserved