The steel stock group has had a huge rally from the recent low point in February 2016, just following the remarkably calamitous HRB price decline on the world market in December 2015 (with the price falling to about $270 per tonne or far below the marginal cost of the median steel mill). Also, in early 2016, the export price was still near the lows and the mills were not yet filing an avalanche of trade suits against the Chinese mills.

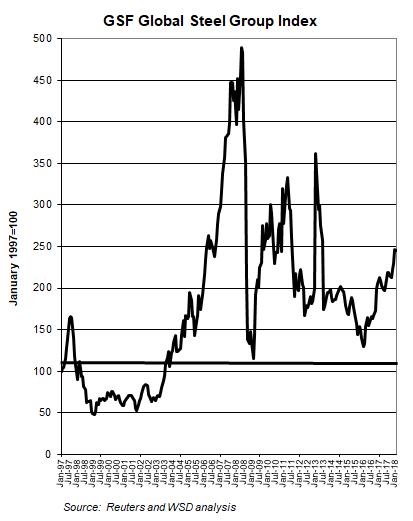

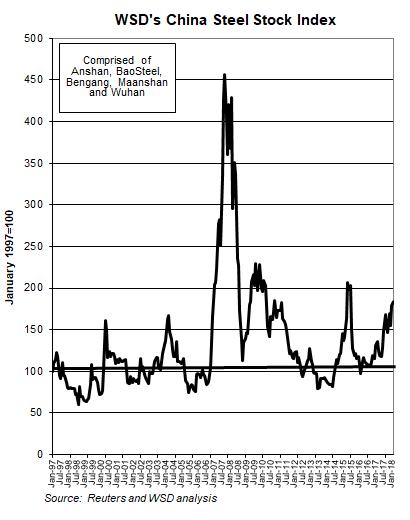

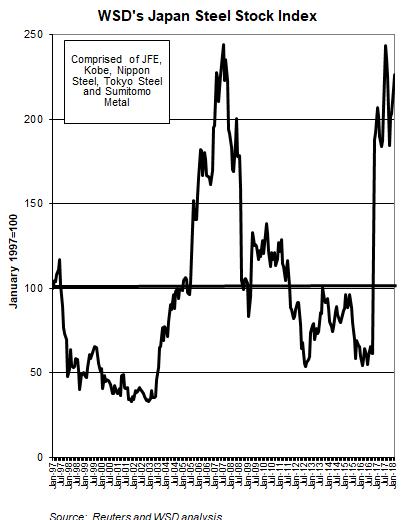

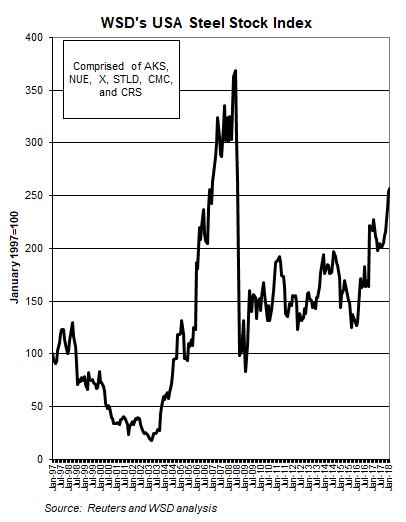

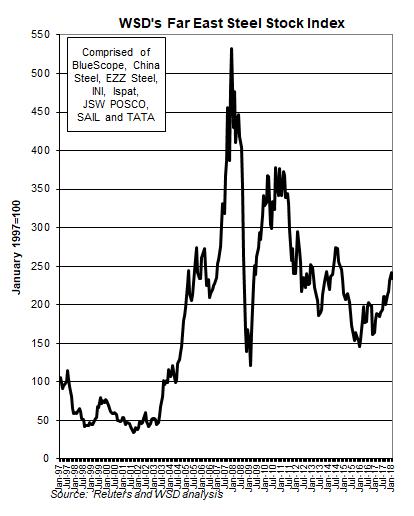

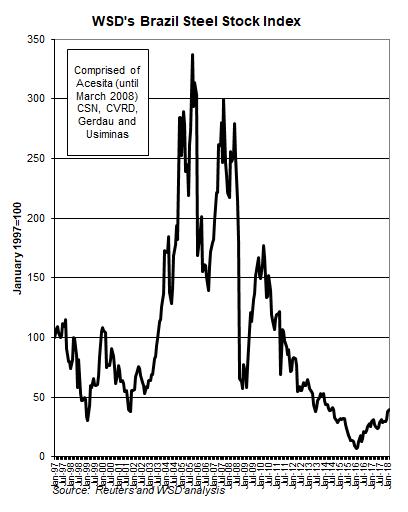

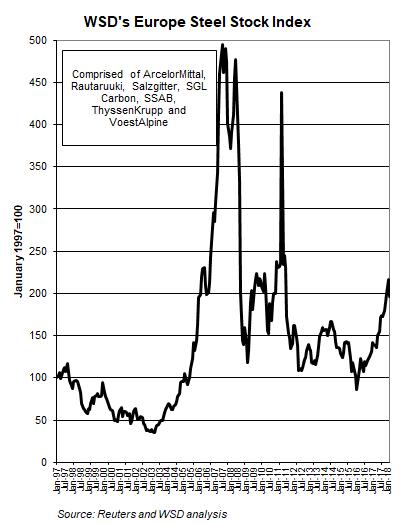

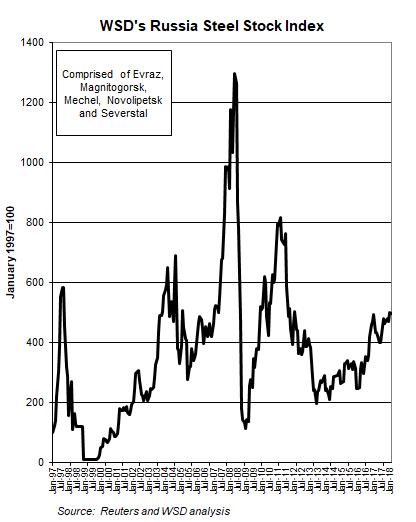

From the low point, the composite Global Steel Group Index is up 84%. For individual countries, Chinese steel stocks are up 88%; Japanese 263%, USA 95%, Far East 61%, Western Europe 129%, Russian 103% and Brazilian 387%.

As of mid-March 2018, a global steel shortage is in effect for hot-rolled band, with the average export price at $640-650 per tonne, FOB the port of export. The export price in February 2016 was just $278 per tonne, FOB the port of export. Versus the global steel stock rally of 84%, the HRB export price is up 132%.

Interestingly, the Global Steel Group Index peaked in May 2008. Just two months later, in the midst of a remarkably severe steel shortage from a price point of view, the HRB export price for several weeks spiked to about $1,150 per tonne, FOB the port of export.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright Ó 2018 by World Steel Dynamics Inc. all rights reserved