Rapid swings in the psychology of the steel marketplace, with the steel buyer at times being advantaged and disadvantaged, are a normal circumstance in the steel industry. What we know is that, when prices appear to be extremely depressed, there seems to be a greater upside price potential relative to the downside - in other words, price allocates resource. We also know that the steel export price outlook is always a wild card.

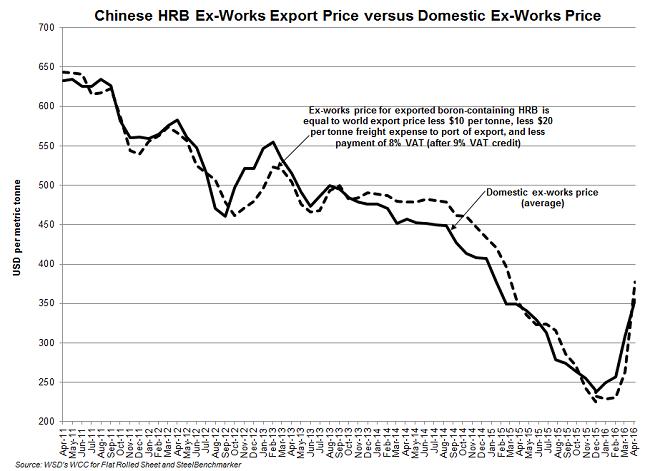

In order to have better insight into when a substantial shift - let's call it a reverse - in market psychology may be imminent, WSD has decided to calculate continually the Reward/Risk ratio for the price of hot-rolled band on the world market, in China and in the United States. What we know in China's case, at least up to the present, is that the mills' ex-works HRB price for the domestic market has tended to move closely with and be about the same as its export price. The Chinese don't have the luxury, as do steelmakers elsewhere, of being able to dump their product on the world market at a far lower price than their home price.

In December 2015, the Chinese export price, which was being matched by steelmakers in many other countries, declined to only about $270 per tonne, FOB the port of export. After subtracting the 8% value-added-tax on exports - only the Chinese pay an export tax - and an average freight cost to the port of export of $20 per tonne, including loading the steel on the ship, the Chinese steel mills' ex-works export price realization was only about $225 per tonne. This figure compared to the marginal cost of the median-cost Chinese mill last December, based on WSD's monthly-updated World Cost Curve for 180 steel plants globally, of $302 per tonne including plant overhead costs. Hence, the median-cost Chinese steel mill was suffering a $77 per tonne loss compared to its marginal cost - a figure relative to steel mills' costs globally that was, by far, the worst in the history of the steel industry in WSD's opinion.

Last December, from the steel buyer's viewpoint, if there was $20 per tonne of risk in the price and $170 per tonne of reward, the Reward/Risk ratio would be 8.5X. In comparison, in May 2016, the world export price is about $500 per tonne, FOB the port of export, or 85% higher than in December 2015. If the May 2016 reward price is $575 per tonne and the risk price is $325 per tonne, the R/R ratio is only 0.4X.

What developments might cause the steel buyer, in his or her mind, to raise the reward price to an even higher figure? One development could be a sharp improvement in the global economic outlook - an unlikely occurrence in WSD's opinion. In fact, WSD thinks that global steel production in 2016 will be down because of reduced steel demand.

Because the R/R figure is so low in May 2016, WSD expects that at some point in the period just ahead there will be a marketplace "chill" in which steel buyers decide to "sit on their hands" and stop ordering ahead to as great an extent as possible. This chill could be precipitated by a decline in international iron ore or steel scrap price.

What's great about the calculation of the R/R ratio is that it's based on a subjective judgment by the steel marketplace observer about what's in the mind of the steel buyer. Economics is the study of the human equation in the marketplace.