According to a statement released by the Turkish Steel Producers’ Association (TCUD), in September this year crude steel production in Turkey increased by 7.2 percent year on year to 3.19 million mt, maintaining its position as the world’s seventh largest steelmaking country, while in the first nine months production rose by one percent year on year to 28.07 million mt. In September, Turkey’s billet and slab production amounted to 2.03 million mt and 1.15 million mt, up 8.6 percent and 4.8 percent year on year, respectively. In the January-September period, Turkey produced 17.81 million mt of billet, up 4.2 percent, against 10.25 million mt of slab, down 4.1 percent, both compared to the same period of 2024.

In the given month, finished steel consumption in Turkey rose by 9.6 percent year on year to 3.1 million mt, while in the January-September period the country’s finished steel consumption increased by 3.9 percent year on year to 28.9 million mt.

In September, Turkey’s steel exports rose by 7.6 percent to 1.4 million mt, while the value of these exports decreased by 0.2 percent to $900.5 million, year on year. In the first nine months, the country’s steel exports rose by 12.1 percent to 11.4 million mt, while the value of these exports increased by 3.8 percent to $7.7 billion, both year on year. Flat and long product exports in the January-September period amounted to 4.99 million mt and 5.94 million mt, respectively, with increases of 10.8 percent and 9.4 percent year on year, while semi-finished product exports amounted to 454,610 mt.

In the ninth month of the current year, Turkey’s steel imports increased by 12.1 percent to 1.5 million mt, while the value of these imports moved up by 2.9 percent to $1 billion, both year on year. In the January-September period, the country’s steel imports increased by 17.2 percent to 14.2 million mt, while the value of these imports moved up by 3.6 percent to $9.9 billion, both year on year. Looking at the imported products, flat and long product imports in the first nine months amounted to 6.79 million mt and 1.15 million mt, respectively, with increases of 11.2 percent and 16.2 percent year on year, while semi-finished product imports amounted to 6.21 million mt.

In the first nine months, Turkey’s steel export to import ratio increased to 77.95 percent, from 77.78 percent recorded in the same period of the previous year.

According to the TCUD, Following the 50 percent import tariff imposed by the US, the EU has proposed a new safeguard measure aiming to reduce quotas by 47 percent and impose a 50 percent tariff on imports exceeding the quota volumes. Additionally, countries such as Mexico and Canada are planning similar measures, leading to a situation where a significant portion of the global steel market is closed to external supply. This situation makes it inevitable for countries with high capacities, especially China, Far Eastern countries and Russia, that cannot export to the countries above, to turn to the Turkish market. The association stated that, under conditions where Turkey's steel consumption continues to increase, it is important to meet demand from the domestic market. Although the Turkish steel industry currently has the capacity to meet domestic consumption, the capacity utilization rate is extremely low at 63 percent. The share of imports in total consumption in the country is reported to be around 48 percent, compared to the 20 percent that the EU is seriously concerned about and plans to reduce to 12 percent through quota reductions. The TCUD stated that it is important to implement measures similar to those taken by the US and the EU to increase capacity utilization rates in the Turkish steel industry and to maintain its competitiveness against countries receiving state support.

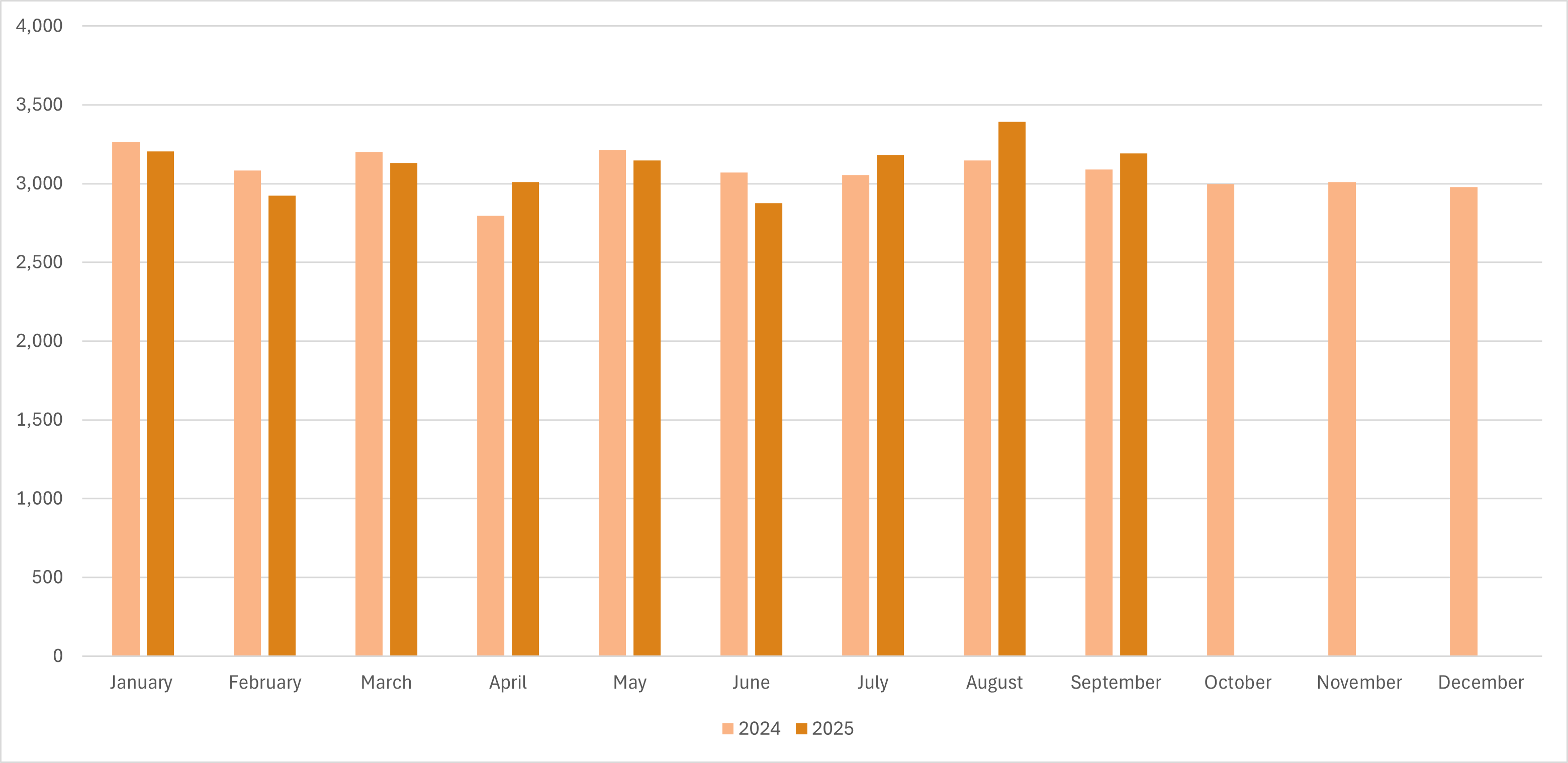

Turkey's crude steel production - September 2025