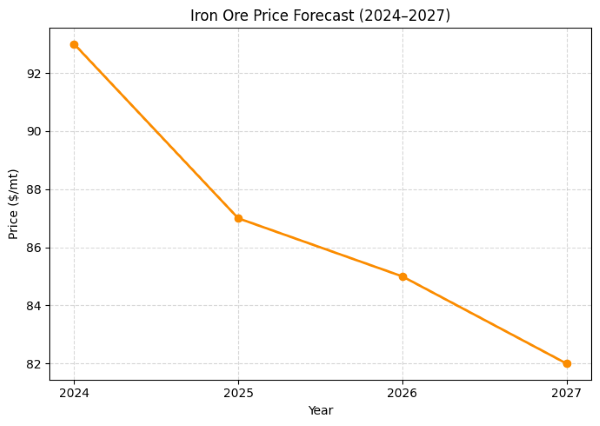

Australia’s Department of Industry, Science and Resources has announced that it is projecting a gradual decline in iron ore prices until late 2027 due to weak steel demand and higher iron ore supply.

Iron ore spot prices have been stable at just above US$100/mt since August this year. Although steel production in China has declined, iron ore prices have remained stable due to increased stockpiling by Chinese buyers. A pricing dispute between Australian miner BHP and China Mineral Resources Group (CMRG) has resulted in Chinese mills rejecting some BHP cargoes. In addition, global iron ore trade is expected to grow by 1.5 percent per year through 2027, with new supply from Guinea-based Simandou mine, Brazil, and expanded Australian mines. The Simandou mine commenced operations in November this year and will have a maximum capacity of 120 million mt per year.

From US$93/mt in 2024, the iron ore price is forecast to average US$87/mt in 2025, falling to US$85/mt in 2026, and then to US$82/mt in 2027.

Global steel output weighs on iron ore demand

Global steel production - a key driver for iron ore demand - declined by 1.9 percent year on year in the first 10 months of this year, totaling 1.52 billion mt, mainly due to lower production in China, the EU, Japan, South Korea and Russia. It is projected that global steel output will drop by two percent in 2025 due to slower global economic growth and construction activities, higher trade barriers and output cuts in China.

The department has also emphasized that iron ore export earnings are forecast to drop by the fiscal year 2026-27, due to weaker prices, declining ore grades, and a stronger US dollar/Australian dollar exchange rate.

| Fiscal Year | Previous Estimate | Revised Forecast | Change |

| 2024-25 | A$116 billion | A$116.4 billion | +A$0.4 billion |

| 2025-26 | A$104 billion | A$114.4 billion | +A$10.4 billion |

| 2026-27 | A$97 billion | A$107.4 billion | +A$10.4 billion |