Import scrap purchases have slowed down in Turkey. Having concluded scrap deals in the past week from the Mediterranean region and St. Petersburg, Turkish steelmakers may look at short sea scrap offers for new transactions in the coming period, given the higher deep sea scrap prices. Ex-US scrap offers have reached $410-413/mt CFR, while Turkish producers, who are experiencing tighter profit margins at the moment, are not in a rush to conclude import scrap bookings for their January stocks as no improvement has been registered in their finished steel export activity. In the meantime, import scrap prices will likely remain strong due to the upward trend of scrap prices in the local US market and expectations for this price movement to continue in the coming period.

An ex-St. Petersburg A3 scrap deal, meanwhile, has been concluded in Turkey at price levels of $390-395/mt CFR, while a booking for Romanian scrap has been concluded in Turkey at $385-390/mt CFR. Scrap supply shortages still prevail in the Black Sea region, but it is very likely that Turkish mills will continue to evaluate short sea scrap offers in the days ahead. Overall, foreign scrap suppliers have withdrawn their offers for now, while they will give offers again in January, when they are expected to ask for higher prices. The Turkish scrap market is not expected to see much activity this week.

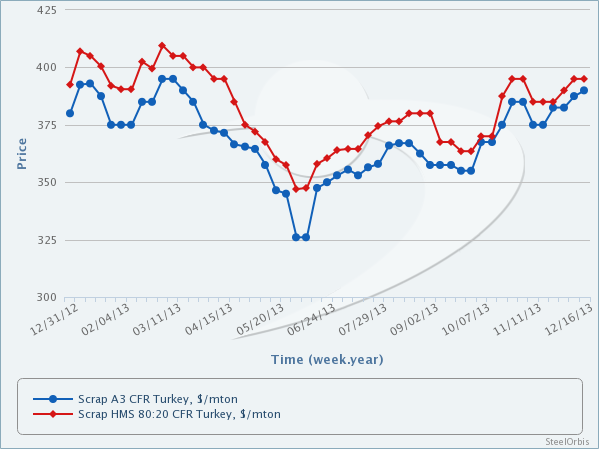

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.