A price correction of $8-10/mt has been observed in the Turkish scrap market, where prices followed an upward trend from the beginning of 2007 till the second half of March. The level which prices will eventually reach has been a matter of some concern to those involved in the market.

Deciding to accept the new price levels, the Turkish mills which had been quiet and absent from the market for a long time finally returned to the market last week to commence scrap purchases. The price levels in the bookings concluded towards the end of last week are as follows:

PNS scrap ex-deep sea |

$370/mt CFR Turkish ports |

Shredded scrap ex-deep sea |

$365/mt CFR Turkish ports |

HMS I/II 90:10 ex-deep sea |

$361/mt CFR Turkish ports |

HMS I/II 80:20 ex-deep sea |

$359.50/mt CFR Turkish ports |

Looking at the prices above, we see that the price of shredded scrap, which was at $373/mt CFR Turkish ports two weeks ago, decreased to a level of $365/mt CFR Turkish ports after the above-mentioned price correction.

The pressure on Black Sea origin A3 scrap and small-tonnage scrap ex-Algeria and Israel continues. While Turkish mills are unwilling to pay more than $350/mt for A3 scrap ex-Black Sea, there are various offers from this region ranging from $350/mt to $360/mt. Suppliers, particularly those who have difficulty in keeping stocks, may consent to lower prices.

It is heard that offers for ex-deep sea scrap this week are at the same levels as last week's bookings, as given above. While there is no expectation of a sharp increase or decrease in the prices, it seems that scrap prices have gained some stability.

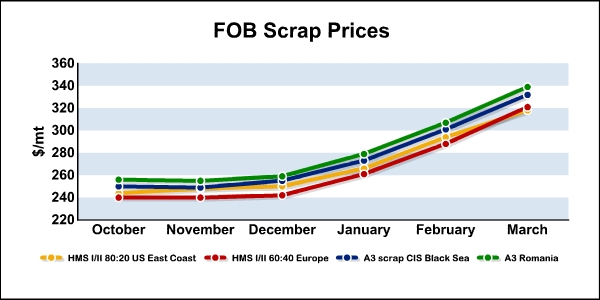

The graph below presents the movement in scrap prices in the period from October 2006 through March 2007: