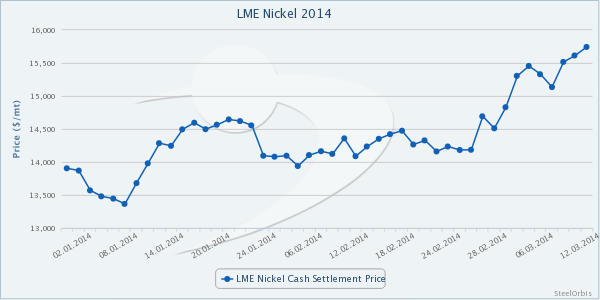

The ongoing upward movement in nickel prices since early March has influenced stainless steel prices as well. Nickel prices have continued to rise this week, with the three-month offer prices at the London Metal Exchange (LME) moving up to the level of $15,700/mt.

Stainless steel mills in China have increased their ferronickel purchase prices, as reported, while China-based LISCO has reduced its stainless production volume amid increased production costs and slow demand. Chinese stainless steel mills are expected to adjust their list prices in the near term, with upward revisions of their offers.

Against the backdrop of increased nickel prices, local and import stainless steel prices in Turkey have moved up as well. Chinese offers to Turkey for TISCO and LISCO production prime quality ready stock 304/2B stainless steel cold rolled coil (CRC) of 2.0 mm thickness are at $2,350-2,450/mt CIF Istanbul, while Chinese offers for similar materials to be produced after receipt of orders from customers are standing slightly above these levels. In addition, offers for Taiwan-based YUSCO production ready stock materials for the same specifications stand at $2,400-2,500/mt CIF.

In the meantime, both ex-works and ex-warehouse basis stainless steel prices in Turkey have increased by $50-60/mt since last week. Offers on ex-works basis are at $2,600-2,650/mt, while local traders and stockists' sales prices are at $2,650-2,750/mt ex-warehouse. Demand in the Turkish domestic market is not that strong, but inquiries have increased in line with the uptrend of nickel prices. The rising trend of stainless steel prices in Turkey is predicted to continue in the coming week, but it is uncertain how buyers will respond to it.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.