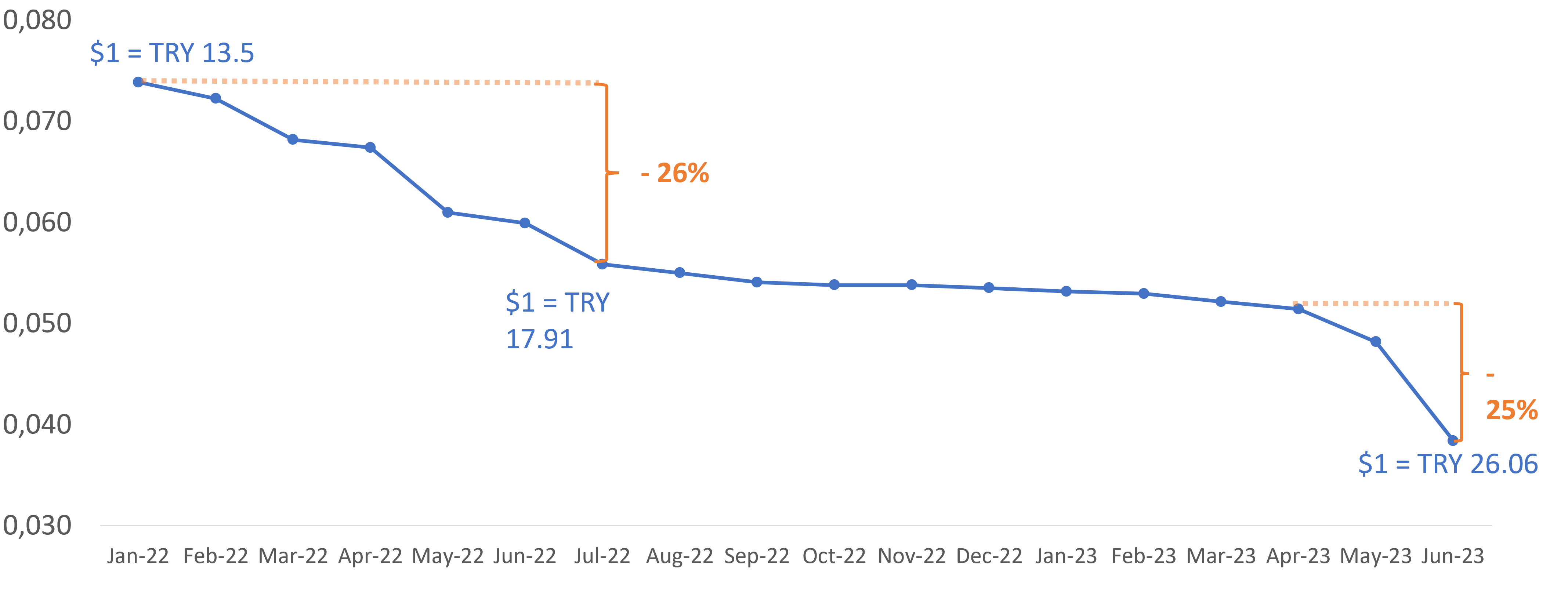

In June, the Turkish lira sank to a new record low losing 25.5 percent in value month on month, falling to $1 = TRY 26.06. The lira weakened significantly after President Recep Tayyip Erdogan’s re-election and the decline in value accelerated after Turkey’s central bank raised the country’s benchmark interest rate by 650 basis points in a dramatic monetary policy reversal. The central bank almost doubled its key interest rate, from 8.5 percent to 15 percent, on June 22, marking the country’s first hike since March 2021.

Turkish lira sinks to new record low in June

Monetary tightening will be further strengthened as much as needed in a timely and gradual manner until a significant improvement in the inflation outlook is achieved. According to government statistics, the country’s annual inflation rate for May stood at 39.59 percent. Last October saw Turkey’s inflation rate soar to 85.51 percent. Turkish finance minister Mehmet Simsek said that a predictable fiscal policy and free exchange rate regime will “ensure that the Turkish lira regains stability and becomes a reliable currency.”

The Turkish metallurgical industry is highly dependent on raw material imports for steel production, and thus directly depends on the national currency exchange rate. About 65-70 percent of its steel scrap needs are imported by Turkey and are purchased in foreign currency, mostly in US dollars. This has a major impact on EAF-based steel production, of long products in particular.

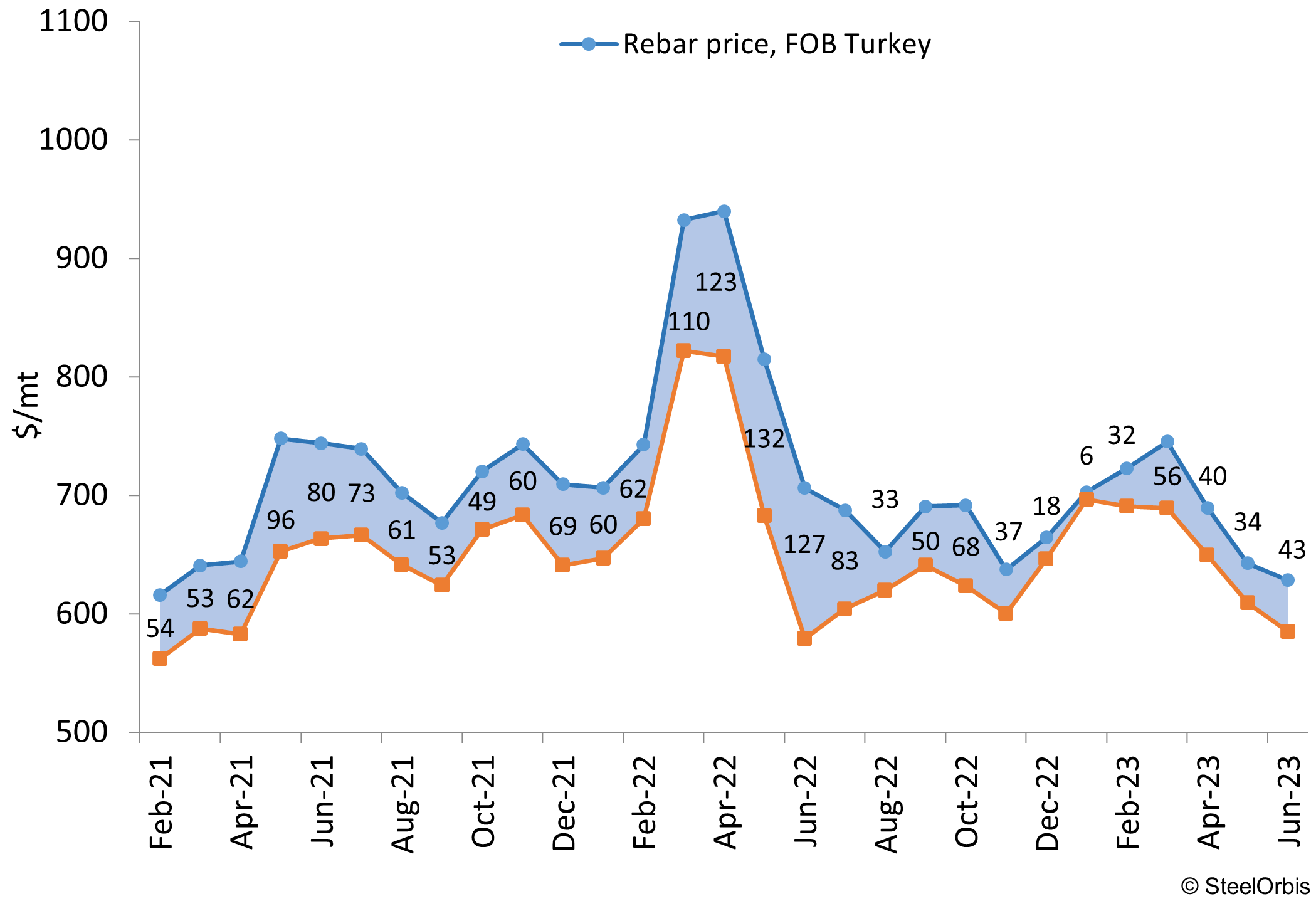

In June, Turkish EAF-based rebar prices in US dollars declined by $25/mt to the level of $575-585/mt ex-works, as a result of reduced energy costs and lower scrap prices. The peak scrap price for HMS I/II 80:20 scrap in Turkey in June was reached at $389/mt CFR in the first week of the month. However, when June ended, benchmark scrap quotations were at $374-379/mt CFR on average, approximately two percent lower than the levels recorded at the end of May. Due to the price drop during the month, average rebar prices on FOB basis in June decreased by $15/mt to $625-630/mt, and the margin of Turkish EAF-based rebar producers increased to $40-45/mt on FOB basis, according to SteelOrbis’ data.

Margins of Turkish EAF-based rebar producers in US dollars, FOB basis

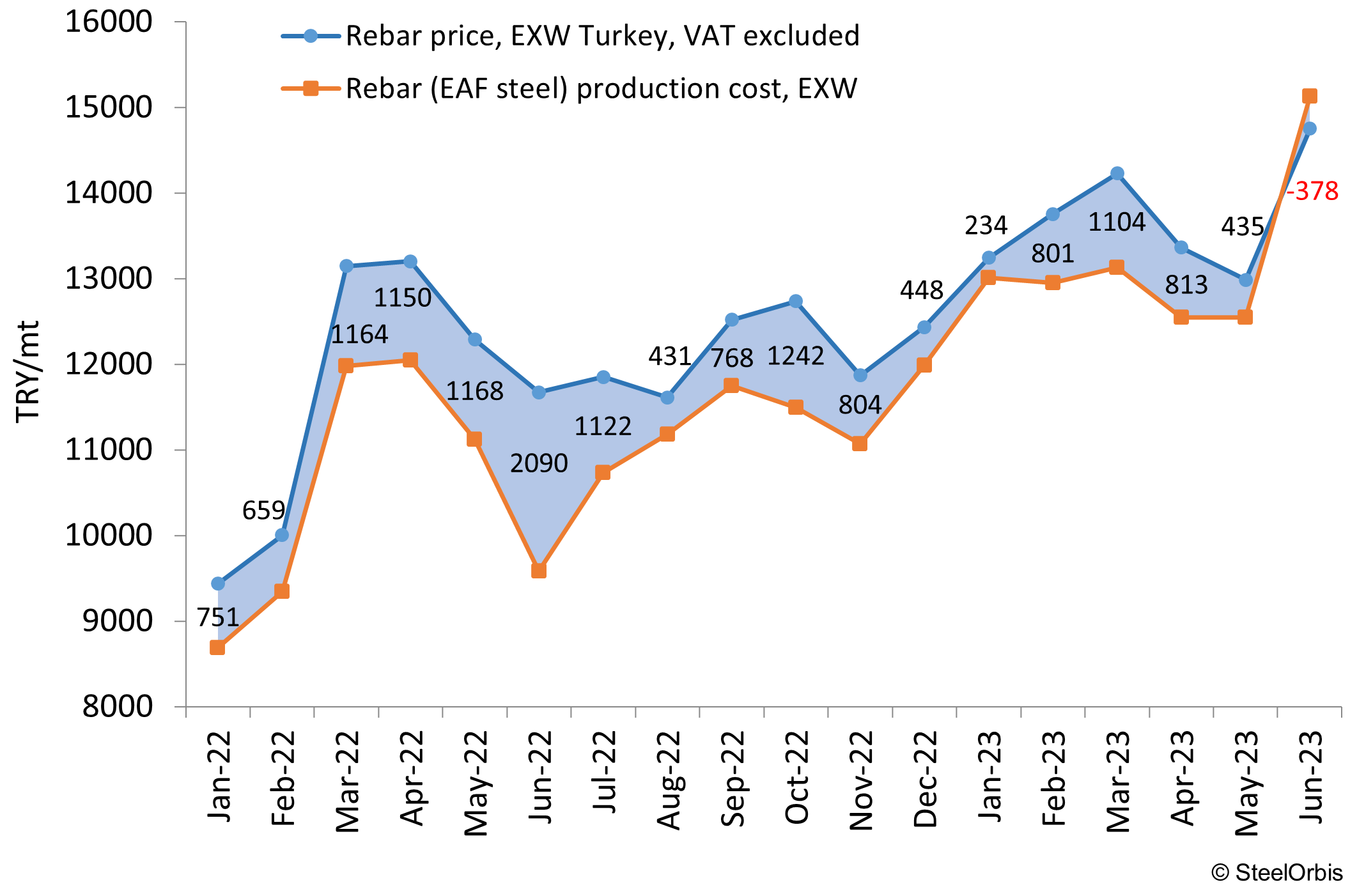

At the same time, in Turkish liras EAF-based rebar prices in June increased by 20 percent to the level of TRY 15,000-15,200/mt ex-works due to higher domestic scrap prices. Turkish mills have focused on domestic scrap procurement and by increasing their quotations have secured good amounts of scrap. While some domestic scrap sellers find the current price levels to be on the low side due to their narrow profit margins, the scrap flow particularly in the southeastern regions of Turkey is considered plentiful. Turkish mills have increased their quotations by TRY 250-850/mt in June, but, due to the sharp depreciation of the Turkish lira, dollar-based quotations have declined by $40-55/mt despite the upward revisions. The general range in the local Turkish domestic scrap market in June rose to TRY 7,850-8,675/mt ($300-335/mt, average exchange rate of $1 = TRY 26.06), from TRY 7,750-7,850/mt ($370-380/mt, average exchange rate of $1 = TRY 20.76) in May.

The natural gas prices used in Turkish industry decreased in June by five percent month on month to TRY 8,520 per 1,000 m3 and declined by more than half from the start of the year. At the same time, the electricity prices for industrial users decline by around 15 percent in June month to month to TRY 1.6-1.7/kWh (TRY 3.5-3.7/kWh in January 2023). Despite a gradual decline in energy prices in Turkey since December 2022, factors such as support for energy-intensive sectors in the EU, the pressure on the Turkish currency since August 2022, the continued implementation of safeguard measures, and the reduced demand in the global steel market led to a drop in Turkish steel exports.

Margins of Turkish EAF-based rebar producers in Turkish lira, ex-works

The higher Turkish lira raw material prices resulted in a steel production cost increase of TRY 2,500-2,700/mt to the level of TRY 15,000-15,200/mt in June, but at the same time average rebar prices on ex-works basis increased only by TRY 1,750/mt to TRY 14,700-14,800/mt (ex-works, VAT excluded). The Turkish lira’s weakening led to a decline in the domestic margins of Turkish EAF-steel rebar producers to the negative zone, according to SteelOrbis’ data. Turkish domestic market rebar prices sank below the cost of production for the first time in 20 months, i.e., for the first time since November 2021. At the same time, as for exports, Turkish manufacturers have sufficient margins to compensate for the disadvantages in the domestic market.

The Turkish lira has been steadily losing strength against the US dollar and local traders are inclined to increase their inventories. Meanwhile, the depreciation of the Turkish lira may provide opportunities in export markets. But this will not apply to the metallurgical industry, as Turkish mills directly depend on imported raw materials for steel production.

More information about the Turkish scrap and steel products markets can be found in the new monthly research report titled “Turkish scrap and steel products markets” on the SteelOrbis site.