The weakening of the Turkish lira and high production costs have added to the difficulties of steel producers in Turkey. Turkey's central bank aggressively hiked interest rates to 25 percent from 8.5 percent in August, signaling its new determination to address rampant inflation as part of a broader U-turn in government policy in Turkey. On September 21, the central bank decided to hike interest rates further from 25 percent to 30 percent to continue the monetary tightening process in order to anchor inflation expectations as soon as possible and to control the deterioration in pricing. The average lira exchange rate in the summer months dropped by 34 percent to $1 = TRY 26.56, from $1 = TRY 19.81 in spring. In September, the Turkish lira continued to lose value and in the first two weeks of the month it weakened further to $1 = TRY 27.02.

The interest rate hikes and the hawkish monetary tone were the strongest signals of a policy reversal after years of loose policy under President Erdogan, who had previously prioritized growth and investments. Erdogan's past drive to slash interest rates sparked a currency crisis in late 2021 and sent inflation above 85 percent last year.

Turkey is facing serious economic strains, with its foreign exchange reserves depleted and the lira having tumbled in value in recent years. The new government forecasts show annual inflation rising to 65 percent by the year-end before dipping to 33 percent next year, up from 24.9 percent and 13.8 percent respectively in forecasts in the previous year. GDP growth forecasts have been cut to 4.4 percent this year and 4.0 percent next year, still higher than most economists expect. Annual consumer prices are foreseen to rise to around 60 percent by the year-end due partly to the depreciation of the currency. The central bank said that rising oil prices and the deterioration in inflation expectations suggest that inflation will end the year at the upper end of forecasts.

The Turkish metallurgical industry is highly dependent on raw material imports for steel production, and thus directly depends on the national currency exchange rate. About 65-70 percent of steel scrap requirements are imported into Turkey and are purchased in foreign currency, mostly in US dollars. This has a major impact on the cost of production of EAF-based steel products, in particular long products.

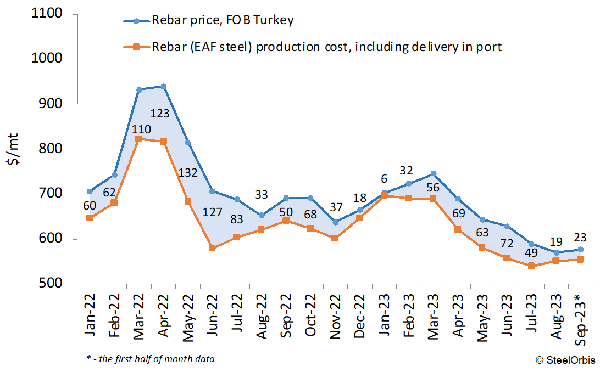

In the first half of September, Turkish EAF-based rebar production costs in US dollars remained mostly stable at the levels of $550-555/mt on ex-works basis compared to August. Deep sea scrap prices for Turkey have remained firm. Despite the mixed mood in Turkey regarding scrap prices and steel demand, suppliers even managed to increase their quotations a little. Due to the price rise during the first half of the month, average rebar prices on FOB basis in September increased by $10/mt to $570-580/mt, and the margins of Turkish EAF-based rebar producers increased to $20-25/mt on FOB basis, according to SteelOrbis’ data.

Margins of Turkish EAF-based rebar producers in US dollars, on FOB basis

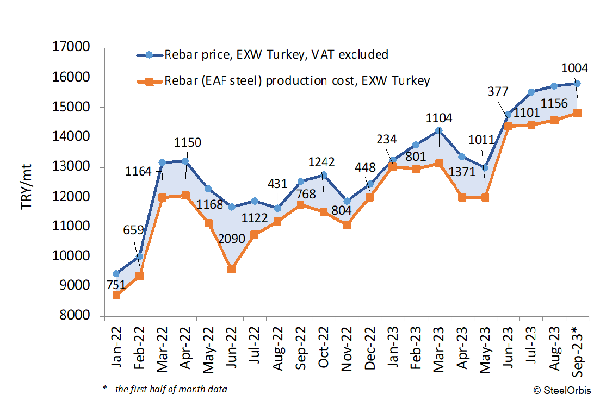

At the same time, the higher Turkish lira-based raw material prices resulted in a steel production cost increase of TRY 250-300/mt to the levels of TRY 14,800-14,850/mt in September. The general range in the local Turkish scrap market for the benchmark DKP grade scrap is still at TRY 9,000-10,150/mt, but import material prices rose in Turkish liras by 3-5 percent. Despite the weaker Turkish lira, domestic rebar prices remained stable at the levels of TRY 15,700-15,900/mt (ex-works basis, VAT excluded) in September due to low demand. The margins of Turkish EAF-based rebar producers decreased in September to TRY 1,000/mt in the domestic market on ex-works basis (TRY 1,150-1,200/mt in August), according to SteelOrbis’ data.

Margins of Turkish EAF-based rebar producers in Turkish liras, ex-works basis

Despite a gradual decline in energy prices in Turkey since December 2022, factors such as support for energy-intensive sectors in the EU, the pressure on the Turkish, the continued implementation of safeguard measures, and the reduced demand in the global steel market led to a drop in Turkish steel exports. There are rumors in the Turkish market about a new round of imminent electricity price increases in the autumn months. Prices could be hiked by 30-50 percent or even higher. According to SteelOrbis’ calculations, if prices rise by 30 percent, EAF-based crude steel production costs will increase by at least $10-15/mt, and, if prices rise by 50 percent, costs will increase by $20-25/mt. The BOF-based crude steel production costs may increase by $5-10/mt and $10-15/mt in these respective cases. This will worsen the already difficult situation for Turkish steel producers, especially in the export markets. Access to affordable, fossil-free electricity is critical for the Turkish steel sector to remain globally competitive.

The Turkish lira has been steadily losing strength against the US dollar and local traders are inclined to increase their inventories. Meanwhile, the depreciation of the Turkish lira may provide a window for the Turkish economy to rebound and avail of opportunities in export markets. But this will not apply to the metallurgical industry as Turkish mills depend directly on imported raw materials for steel production.

More information about the Turkish scrap and steel product markets can be found in our new monthly Research Report “Turkish scrap and steel products markets” on the SteelOrbis website.