Despite a slight firming trend a few weeks ago, domestic rebar buyers have reacted to the recent sideways price move with disdain.

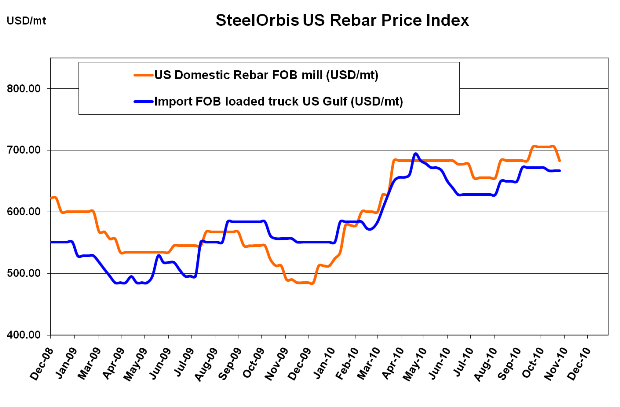

There hasn't been any measurable drop in demand since last price announcement to explain the current lack of acceptance of official mill asking prices for rebar, but many distributors feel that demand wasn't strong enough earlier in the month to justify a neutral transaction price move in reaction to the $30/long ton drop in shredded scrap prices. As such, most spot prices have dipped below the current official asking price range of $31.75-$32.25 cwt. ($700-$711/mt or $635-$645/nt) ex-mill, and are now back to prices seen before the $1.00 cwt. ($22/mt or $20/nt) price increase announced in mid-September, in the range of $30.75-$31.25 cwt. ($678-$689/mt or $615-$625/nt) ex-mill.

It will be interesting to see how domestic rebar mills react to the various scenarios swirling in the market regarding November scrap pricing. If shredded scrap reverts back to September prices by increasing $30/lt next month, rebar mills would likely have a difficult time passing off any sort of price increase, but it might help to firm up spot prices closer to current asking prices. But if scrap drops as some others predict, even by a slight $10-$20/lt, it could significantly destabilize an already weak market.

Such uncertainty in the market has kept import activity quiet, especially from overseas-lead times are too much of a gamble right now. Turkish rebar prices have not changed in the last week, holding in the range of $29.75-$30.75 cwt. ($656-$678/mt or $595-$615/nt) duty paid FOB loaded truck in US Gulf ports, but there are still not many takers. Turkish mills have not yet raised import offers as expected, but rebar prices have increased in both the local Turkish market and to export destinations other than the US.

Mexico has also kept prices level after a slight $0.50 cwt. ($11/mt or $10/nt) price decrease last week, as Mexican mills watch and wait for the US scrap announcement expected sometime next week. Current prices are still in the range of $28.00-$29.00 cwt. ($617-$639/mt or $560-$580/nt) duty paid FOB delivered to US border states, but Mexican rebar producers usually prefer the spread between their prices and US prices to be a little wider. As US prices continue to soften, and the spread gets narrower, Mexican rebar prices might need to adjust to stay competitive.