Determined to hold on to their July price increase, US rebar mills see shredded scrap's neutral trend as stability that works in their favor.

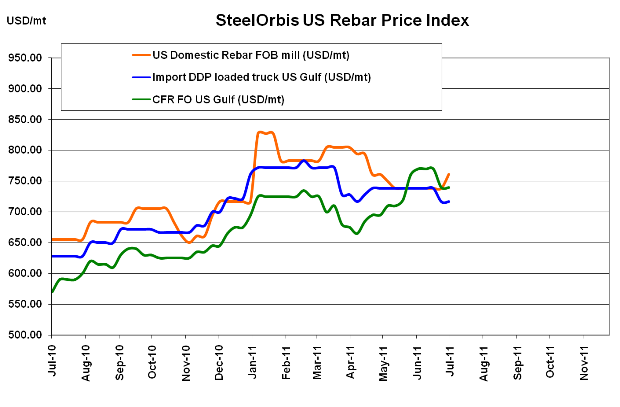

While US domestic rebar mills would have been pleased to see shredded scrap trend slightly up as some recently predicted, they are still determined to use the sideways move this month to their advantage. According to sources, the only thing that could have hampered mills' ability to push through the $1.00 cwt. ($22/mt or $20/nt) price increase for July shipments was a downtrend in scrap--which speculation pointed toward as early as two weeks ago--but the neutral trend announced this week will help keep spot prices firm. Already, the July increase is evident in spot prices, which are now in the general range of $34.00-$35.00 cwt. ($750-$772/mt or $680-$700/nt) ex-mill, up $1.00 cwt. since the end of June. While some sources contend that mills had been quietly flexible with spot prices in the last week or so, scrap's sideways trend will likely embolden mills to push for higher prices across the board.

Typically, neutral scrap prices do not support higher steel prices, except when outside forces such as end-use demand are doing most of the heavy lifting. However, domestic demand for rebar does not seem to be much of a factor in July prices--sources say demand is decent, but still not strong, and tight supply due to summer shutdowns have more influence on mills' ability to push through their July increase.

Imports, on the other hand, are not having much effect on the US domestic rebar market so far this month, even though the margin between Turkish and US rebar prices has widened. Current import offers from Turkey are the same as last week, still ranging from $32.00-$33.00 cwt. ($705-$728/mt or $640-$660/nt) DDP loaded truck in US Gulf ports. Prices in the local Turkish market have been on the rise in the last week, as have most export offers--except to the US. According to sources, US buyers are still relatively hesitant to speculate a few months in the future, but that could change if US prices stay high and supply remains tight.

As for Mexican rebar offers, Mexican mills have observed the uptrend in US domestic rebar prices and responded in kind--offers are now in the range of $34.00-$35.00 cwt. ($750-$772/mt or $680-$700/nt) DDP loaded truck delivered to US border states, up $0.50 cwt. ($11/mt or $10/nt) on the low end and $1.00 cwt. on the high end. However, this increase is said to be temporary and dependent on how well US mills are able to push through their own increase. If Mexican mills sense instability in US prices, they will likely adjust their own offerings accordingly.