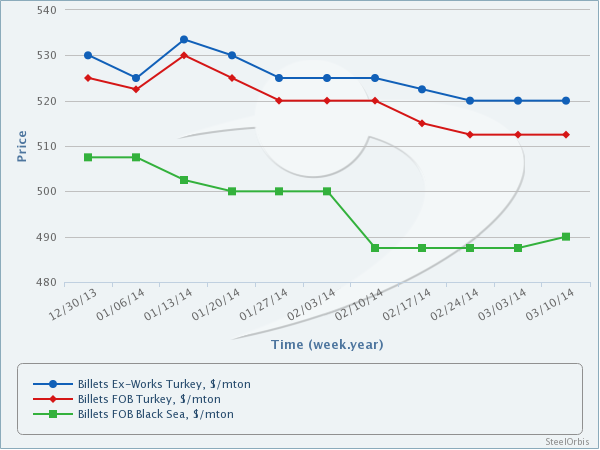

SteelOrbis has learned from market sources that steel billet prices in the Turkish domestic market have remained unchanged since last week at $515-525/mt ex-works.

Despite the supply shortage in the spot market, steel billet suppliers have not managed to adjust their prices upwards, due to the pressure from rebar prices which have remained below the $560/mt mark in the Turkish domestic market.

No ex-CIS steel billet offers to Turkey have been heard this week so far, while market sources report that CIS steel billet suppliers have completed their sales for March production and that they are not in a hurry to conclude new bookings.

Previously, ex-CIS steel billet sales to Turkey for March production had been concluded at $505/mt CFR. New offers to Turkey from the CIS are expected to test higher price levels.

On the other hand, Turkish steel billet export offers are still at $510-515/mt FOB this week, though no transaction has been heard so far in this price range.

Please click in order to view the latest freight rates from Banchero Costa.