While a price uptrend continued last week in the overall European rebar market, a continuation of the same trend may be seen this week in those European countries which were on their Easter holidays last week. Rather than demand, the uptrend in prices of scrap and of imported rebar is the main factor behind the rebar price increases in Europe.

As is known, Turkish rebar offer prices for exports have been on an uptrend in recent weeks. While Turkish producers have been raising their prices on the back of demand from Egypt and the UAE, and also due to the increased prices of scrap and billet, the demand from Egyptian buyers for prompt shipment constitutes an additional factor behind the Turkish producers' price increases. Meanwhile, European producers are following the example of their Turkish counterparts as they also push up their prices.

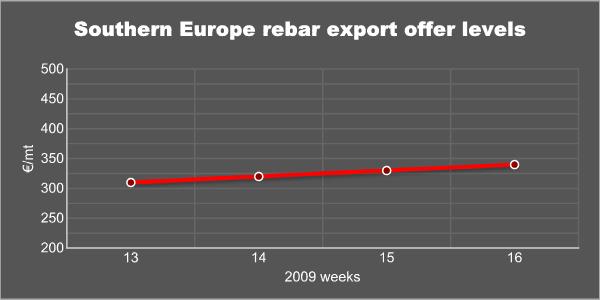

Looking at southern Europe, it is observed that the Italian and Spanish producers are trying to increase their prices. While export offers from both countries are currently at around €340/mt ($442/mt) FOB, it is said that this number may be exceeded this week. Price uptrends are also observed in both countries' local markets. However, no significantly demand recovery is reported. As regards Greece, local producers have been pushing the export markets for levels of €330-340/mt ($429-442/mt) FOB; however, it is heard that deals are at lower levels.

Rebar prices are observed to be on an overall uptrend in the eastern European markets. Producers in Romania and Bulgaria are increasing their prices under the influence of the Turkish producers in particular. Some demand activity is seen in these two countries.

In Latvia, producers are primarily trying to melt their stock levels. It is mentioned that prices are at €280/mt ($364/mt) ex-stock in Latvia.

Producers in the UK have increased their prices by ₤30/mt ($39/mt) in the last two weeks, to the current price level of ₤330/mt ($489/mt) delivered to customer, mostly due to the uptrend in global scrap prices and in import rebar prices.

In conclusion, although prices are increasing in the European rebar markets, demand is not registering a recovery at the same rate. However, it seems that as long as the prices of scrap and imported rebar go up, European rebar producers will also continue to raise their prices.