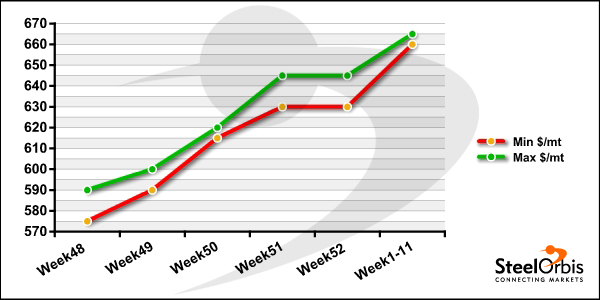

The CIS steel billet market has made a strong start to the New Year, despite the Christmas holiday in the region. While the billet export offers of CIS producers have generally not been clarified yet due to the holiday season, some CIS producers have increased their steel billet export offers for February production to the level of $630/mt FOB.

The good volume of received orders and the strong trend seen in the raw material markets provide support for high steel billet prices, while steel billet producers in the CIS are expected to return to the market after the holiday with even higher prices. This week, steel billet offers from the CIS to Turkey have increased to the level of $640-655/mt CFR.

On the other hand, the Turkish steel billet market has started the current week with price increases, due to ongoing increases in scrap prices after the Turkish mills' latest scrap bookings. Turkish producers' steel billet export offers have increased to $660-665/mt FOB; however, the price idea of buyers still stands below the $660/mt FOB level.

As SteelOrbis previously reported, on January 6 Turkish long steel producer Kardemir opened its steel billet sales at the price level of $656-660/mt + VAT - raising its prices by $55/mt. The producer closed its sales the very same day, after selling approximately 31,000 mt. Turkish rolling mills, unable to find cheaper steel billet supplies, are still confronting higher steel billet costs.

Buyers in Far East Asia are not reacting positively to the rapidly increasing steel billet offers. In the Far East, steel billet offers from South Korea, Taiwan and Russia stand at $640-650/mt, while demand from buyers is slow.

Next week, the steel billet market is expected to make a strong start following the significant price increases in Turkey's latest scrap transactions.

Turkey's steel billet export offers: