Decent demand levels and early speculation of a possible uptrend in scrap next month have many wondering if US wire rod prices will soon follow.

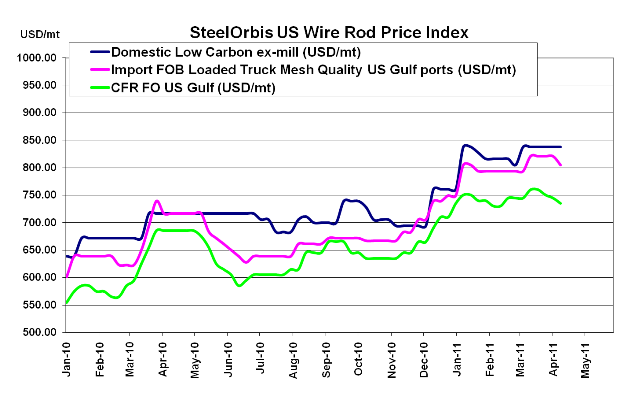

While US domestic wire rod mills are expected to leave official asking prices level for May shipments, there are signs that spot prices could firm up and close the current $2.00 cwt. ($44/mt or $40/nt) gap in the near future. Spot ranges have not moved yet, still hovering in last week's range of $37.50-$38.50 cwt. ($827-$849/mt or $750-$770/nt) ex-Midwest mill, but SteelOrbis has learned that only large-tonnage customers are paying the low end of the range, while nearly everyone else is concluding transactions on the high end.

Speculation that wire rod prices could firm are partially attributed to rumors of an expected uptrend in shredded scrap pricing next month--export demand from Turkey and China should pick up soon, which could very well affect domestic scrap prices. Decent demand is also keeping wire rod prices level, but while auto production is one of the main drivers for wire rod demand, there are still concerns that auto part shortages from Japan will put a significant dent in US-based production numbers. On April 11, Toyota spokeswoman Shiori Hashimoto announced that the company could lose production of up to 35,000 cars and light trucks at North American factories through the end of this month. As soon as production resumes, however, US wire rod mills will likely see a spike in demand, further bolstering wire rod prices.

On the other hand, depending on when production resumes, current import offers might lure US buyers to overseas sources. Prices for Turkish wire rod, for example, dropped $0.75 cwt. ($17/mt or $15/nt) in the last week, bringing offers into the range of $36.00-$37.00 cwt. ($794-$816/mt or $720-$740/nt) duty paid FOB loaded truck in US Gulf ports. While sources tell SteelOrbis that Turkish mills believe prices have "nowhere to go but up," it is not clear when-or if-they will be able to firm up their offers to the US.