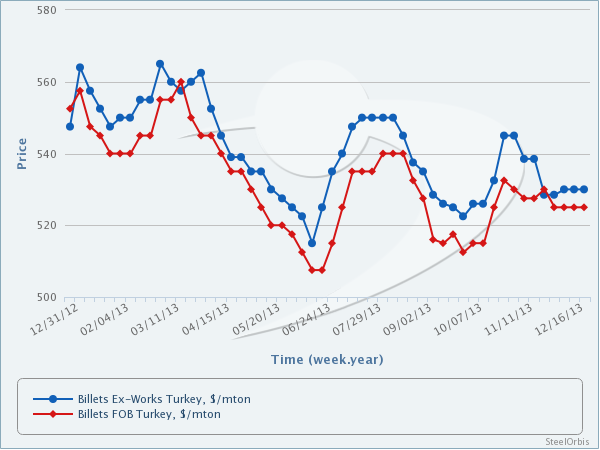

SteelOrbis has been informed by market players that billet prices in the Turkish domestic market are still ranging at $525-535/mt ex-works, remaining unchanged since last week. Meanwhile, holiday mood has already started to reign the market and local buyers prefer to wait at the moment due to the significant appreciation of the US dollar against the Turkish lira. In the meantime, CIS billet offers for Turkey are also unchanged this week and still can be found at $525-535/mt CFR, but the purchasing activity is unlikely to pick up before January.

On the other hand, Turkish billet export offers have remained stable since last week, hovering at $520-530/mt FOB and a billet sale has been concluded to Morocco at this range. Trading volume in Turkey's billet export markets is on the low side, while buyers' inventories are high in Turkey's target markets, since CIS suppliers conclude high volume deals in these regions at the price level of $500-505/mt FOB.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.