On the other hand, according to market sources, offers from Turkey to the export markets for the same stainless products have remained unchanged week on week in the range of $2,250-2,300/mt ex-works. With the US dollar gaining strength against the euro, European producers have adjusted their prices. Prime quality stainless steel export offers from Europe to Turkey have increased by $255/mt week on week to $2,450-2,500/mt CFR, while second quality stainless steel export offers from Europe to the same destination are currently in the range of $1,950-2,050/mt CFR and are considered to be on the low side. Buyers in Turkey want to focus on ex-Europe second quality products and to conclude purchases of large tonnages, but it is hard to find available tonnages due to the tightness of supply in the market.

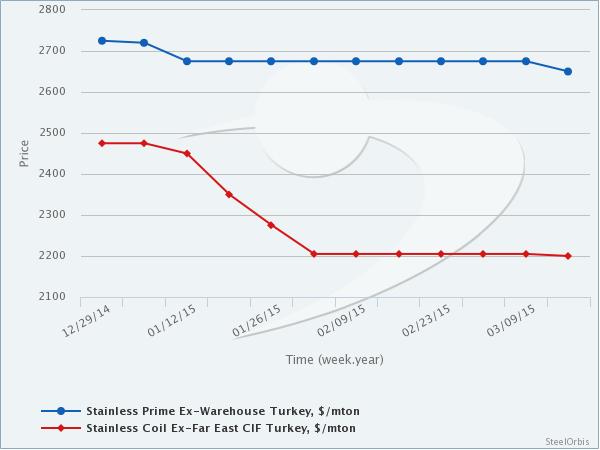

Meanwhile, offers for prime quality 304/2B stainless steel cold rolled coil (CRC) of 2.0 mm thickness from China and Taiwan to the Turkish market have declined by $10/mt over the past week to $2,100-2,300/mt CIF Izmit.

The cash and settlement nickel price at the London Metal Exchange (LME) has trended downwards since March 12, decreasing by $195/mt and closing the day at $13,630/mt on March 19.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.