Demand in the Turkish hot rolled coil (HRC) market has remained at weak levels, while prices have been trending sideways. Meanwhile, tight availability of hot rolled pickled and oiled coil still exists. Local traders state that tightness of availability has helped maintain prices in the market at unchanged levels, but that stock shortages also cause delays in sales activities.

Market sources state that some domestic producers have announced their new HRC prices at $590/mt ex-works, for September production. There is uncertainty over whether the new price levels will gain acceptance. If they are accepted, it will also mean that current discounts in the market will be cancelled. Market players are waiting to see the demand situation become clearer after the Ramadan holiday. Meanwhile, domestic producers' HRC prices are currently at $590-600/mt ex-works.

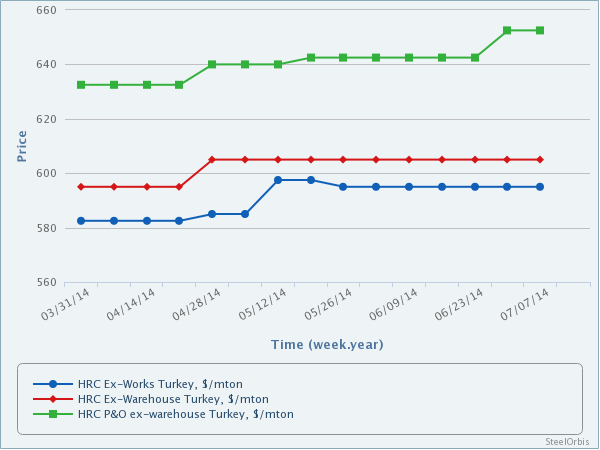

The domestic sales prices of traders for local and imported hot rolled flat steel products in the Eregli and Gebze regions of Turkey are as follows:

Product | Price ($/mt) | |

Eregli | Gebze | |

2-12 mm HRC | 600-610 | 605-615 |

2-12 mm HRC (for large volume sales) | 590-600 | |

1.5 mm HRS | 630-640 | 635-645 |

3-12 mm HR P&O | 645-650 | 655-660 |

The above prices are ex-warehouse and for advance payments, exclusive of 18 percent VAT.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.