Demand in the Turkish hot rolled coil (HRC) spot market has made a quiet start to the current week due to Ramadan which began last weekend. Market sources report that, after the stronger demand in the second quarter, it is normal for demand to slow down, and especially with the influence of Ramadan. In the Turkish spot market, prices of hot rolled pickled and oiled coils have increased by $10/mt as tightness of availability has continued. No similar increases have been reported in hot rolled coil (HRC) prices, but deals have been concluded towards the top of the spot price range due to the ongoing tight availability.

Demand received by domestic producers, which continue to accept orders for August shipment, is still on the weak side. Prices in the market have remained unchanged. Izmir-based steel producer Habaş, which has been making investments for a while now is expected to start HRC production in the near future. The producer has started to take orders for trial production, while the date for completion of trial production is not yet known.

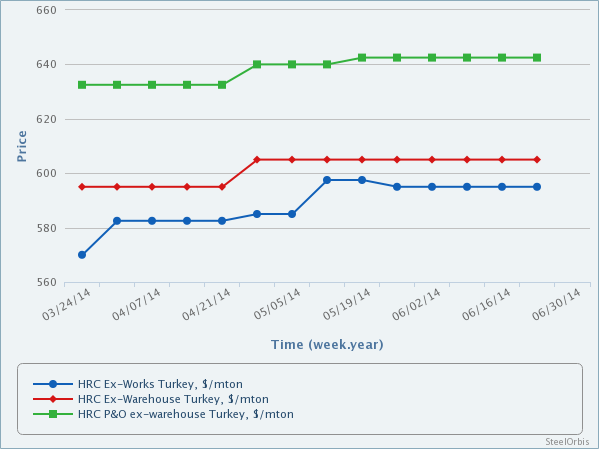

Producers' HRC prices have remained in the range of $590-600/mt ex-works, while $5-10/mt discounts are available to certain buyers and depending on tonnages.

The domestic sales prices of traders for local and imported hot rolled flat steel products in the Eregli and Gebze regions of Turkey are as follows:

Product | Price ($/mt) | |

Eregli | Gebze | |

2-12 mm HRC | 600-610 | 605-615 |

2-12 mm HRC (for large volume sales) | 590-600 | |

1.5 mm HRS | 630-640 | 635-645 |

3-12 mm HR P&O | 645-650 | 655-660 |

The above prices are ex-warehouse and for advance payments, exclusive of 18 percent VAT.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.