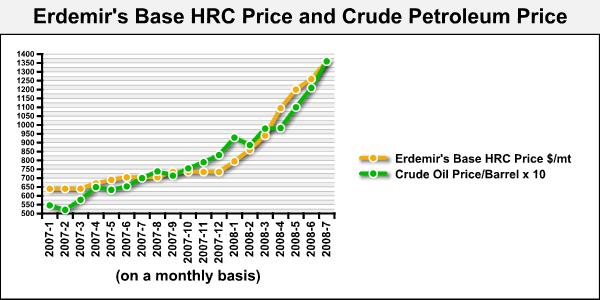

In today's analysis we are going to touch on a very interesting observation regarding the Turkish flats market. When the figures presented above are compared, the conclusion is not only surprising but is also very difficult to believe, at least at first glance.

On the one side of the table are the prices of petroleum per barrel multiplied by 10, on the other side stand Erdemir's base prices for HRC. It could be said that the similarity observed is pure coincidence of the kind that is bound to occur on occasion. However, let's take a closer look at the issue.

Crude Petroleum Price X10 $/barrel | ||

2007-1 | 546 | 640 |

2007-2 | 521 | 640 |

2007-3 | 578 | 640 |

2007-4 | 649 | 670 |

2007-5 | 634 | 690 |

2007-6 | 653 | 705 |

2007-7 | 700 | 705 |

2007-8 | 738 | 705 |

2007-9 | 714 | 735 |

2007-10 | 755 | 735 |

2007-11 | 790 | 735 |

2007-12 | 830 | 735 |

2008-1 | 929 | 795 |

2008-2 | 887 | 860 |

2008-3 | 980 | 940 |

2008-4 | 983 | 1095 |

2008-5 | 1100 | 1200 |

2008-6 | 1210 | 1260 |

2007-7 | 1360 | 1360 |

In the first place, it is a known fact that cash flow is increasing in line with the rising petroleum prices, and those who cannot find the desired profits in the finance markets are turning instead to the commodity markets. This results in an inflationary chain reaction. The greater the cash flow, then the higher the steel consumption and, as manufacturing activities do not accelerate at the same rate as consumption, product prices record an inevitable increase. In this sense, the similarities in the table are not at all surprising.

As long as global iron ore and steel supplies do not satisfy current demand, as long as the global cash flow increases and as long as profit is sought in the commodity markets, the direction of prices in this table will always be upward. Factors that may stop this uptrend could include the appreciation of the US dollar, the switching of cash flow back into the finance sector and the resolution of the supply-demand imbalance.

However, the current conjuncture in the world markets does not seem sufficient to reverse this movement...On the other hand, one of the significant issues to be kept in mind is worldwide inflation itself. Such inflation has always brought crisis in its wake, but all market players are hoping that this will not be the case this time around.