Due to the increased strength of the euro against the dollar, European export offers have become less attractive. While export offers have shown decreases of €20/mt, prices on a dollar basis have declined by a further $5/mt on top of that. As for current flats offers given from Europe to the export markets, HRC base prices are currently in a range of €300-340/mt FOB.

Despite the aggressive import offers in Europe and the fluctuation of the €/$ exchange rate which has caused import materials to become cheaper, importing has become more risky in Europe due to the decrease in lead times from eight weeks to four weeks for flat products. In other words, in the current period when exchange rate fluctuations and price changes are seen more frequently, importing has become harder.

Meanwhile, price levels in bookings and offers have gradually been showing greater differences, climbing to around €80/mt. At present, some integrated facilities are of the view that reduced offers should not be allowed to push the market further down.

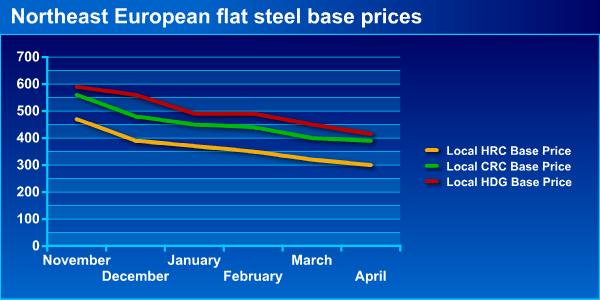

In the northeast European market, HRC prices have decreased by €20/mt on average, CRC prices have shown a decline of €10/mt, while HDG prices have fallen by €35/mt on average, all compared to two weeks ago. Also, in the same period, HRC import offers have deteriorated by an average of €20/mt in the same market. Average base prices for April rolling materials on ex-works basis are as follows; HRC at €290-310/mt, CRC at €390/mt and HDG at €410-420/mt.

In Belgium, ArcelorMittal origin HRC base prices stand at €420/mt ex-works, though actual buyers who are ready to purchase high tonnages are able to obtain a level of €340/mt. Consequently, it is now getting harder to give specific price levels, even in the European market which is known as one of the more transparent markets. Meanwhile, in eastern Europe HRC prices have shown further decreases, declining to the range of €290-310/mt.

Although officially announced CRC prices have reached levels of €440-470/mt in the northwest European market, it is observed that bookings, which had been concluded at €470/mt in February, are now in a range of €400-440/mt. This price range can vary depending on the producer and tonnage. On the other hand, the price difference between HDG and CRC materials has declined to a mere €10/mt. All this indicates that the sectors which consume HDG and CRC, i.e. the metal goods, white goods and automotive sectors, have slowed down to a certain extent.

Expectations among market players for steel prices in the coming period are as follows - First, prices will continue to decrease until the conclusion of the destocking process; then prices will show increases against the background of the recovery seen in infrastructure investments and consumer demand with the help of support packages announced by the European governments and other international institutions; subsequently, prices will show a softening again due to decreased raw material costs in particular, as well as due to the uptick in supply as an early reaction. Finally, prices will show a recovery again with the conclusion of the crisis.