Demand in the local Turkish hot rolled coil (HRC) spot market is still on the strong side, while domestic HRC prices have remained unchanged over the past week. However, players in the spot market state that demand for Turkish producers' HRC has slackened over the same period and that any price increase is likely to meet resistance from the market. Traders, who are satisfied with the current demand they are receiving, say that an upward price revision may weaken demand. Even though they believe a price increase is necessary due to their low profit margins, they prefer not to revise their prices at present.

Meanwhile, Turkish producers have been seriously impacted by the declines seen in Chinese HRC offer prices and in prices of iron ore - the raw material used by most Chinese producers. While demand for Turkish producers' HRC products has softened over the past week, buyers' reluctance to conclude transactions for November production and the increased strength of the US dollar against the Turkish lira have helped make discounts more widespread in the market. Even though Turkish producers' HRC prices have remained unchanged in the range of $590-605/mt since last week, discounts of up to $10/mt are available to certain buyers and depending on tonnages.

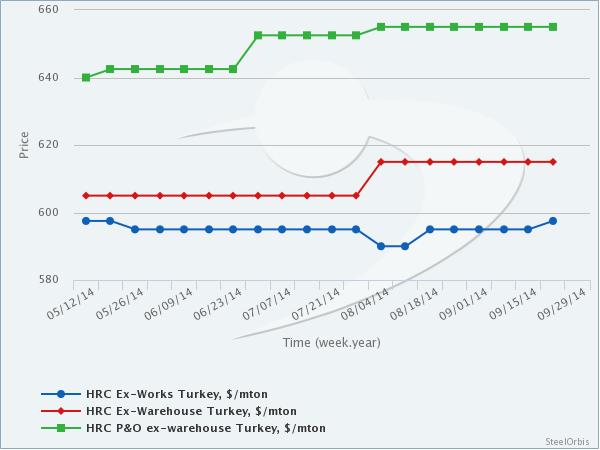

The domestic sales prices of traders for local and imported hot rolled flat steel products in the Eregli and Gebze regions of Turkey are as follows:

Product | Price ($/mt) | |

Eregli | Gebze | |

2-12 mm HRC | 610-620 | 615-625 |

2-12 mm HRC (for large volume sales) | 600-610 | |

1.5 mm HRS | 640-650 | 645-655 |

3-12 mm HR P&O | 650-660 | 660-670 |

The above prices are ex-warehouse and for advance payments, exclusive of 18 percent VAT.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.