Medium Term, WSD thinks that the price of iron ore delivered to China could fall for an extended period of time – let’s say two years or so – to about $80 per tonne. Then, presuming that the low price drives away a number of the higher cost suppliers, the price may rebound to about $90 per tonne.

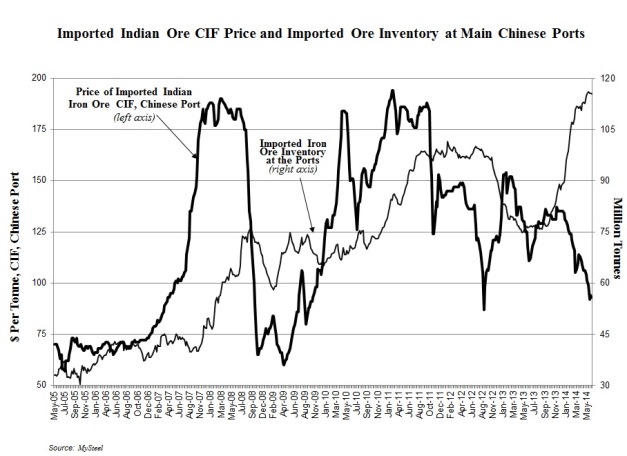

Near term, the iron ore price delivered to China in the next six months could drop to $70 per tonne, although this is not our expectation. The current price is about $90 per tonne down from the recent high of $139 per tonne in December 2013. The possible price range for the remainder of 2014 is substantial – i.e. $70 to $105 per tonne, in our opinion. Given the volatility in the iron ore price, we expect sizable expansion in iron ore futures activity because of the iron ore buyers’ and sellers’ need to hedge the price risk.

The ocean freight cost in the future to deliver iron ore from Australia to China is assumed to be about $8 per tonne, with that from Brazil about $17 per tonne. Standard iron ore pellet is assumed to sell in the years ahead at about a $25 to $30 per tonne premium (currently about $40 per tonne) to the sinter feed price, while DR pellet (pellet for directly-reduced iron plants) may sell at a 7-10% premium to standard pellet price.

Reasons for a possible further price decline this year as well as factors impacting the price longer-term include:

• Iron ore oversupply: The global oversupply is huge at present as: a) iron ore capacity outside of China is still rising sharply; and b) the largest iron ore producers are unwilling to significantly cut back output. The depreciation of the Brazil's currency has lowered the relative cost to mine and pelletize iron ore in that country. Smaller iron ore sellers are creating additional downward pressure on prices by offering to sell their product at lower prices than the largest companies. Although the Chinese iron ore cost curve is steep based on WSD's World Cost Curve data, capital spending in the Chinese iron ore industry remains substantial at about $25-30 billion per year.

• Slowing demand for iron ore: Chinese steel demand growth has slowed and is likely near its plateau. WSD expects that residential construction, which has been one of the crucial drivers of Chinese steel demand, is likely to drop by 2018 to 6-7% of GDP from 12-13% currently. Chinese steel product exports have also probably reached an unsustainable peak at present at about 95 million tonnes annualized.

• Chinese iron ore inventory: Banks in China are apprehensive about their iron ore inventory loans. The number of Chinese iron ore traders is plummeting due to reduced access to bank financing.

• A growing supply of steel scrap: WSD believes that steel scrap prices are currently overpriced by perhaps $50 per tonne, and that prices will come under even greater pressure over the next decade as scrap recovery grows rapidly in China. If the steel scrap price drops sharply, it will become far more competitive for use in BOF steelmaking furnaces in China and elsewhere.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2014 by World Steel Dynamics Inc. all rights reserved