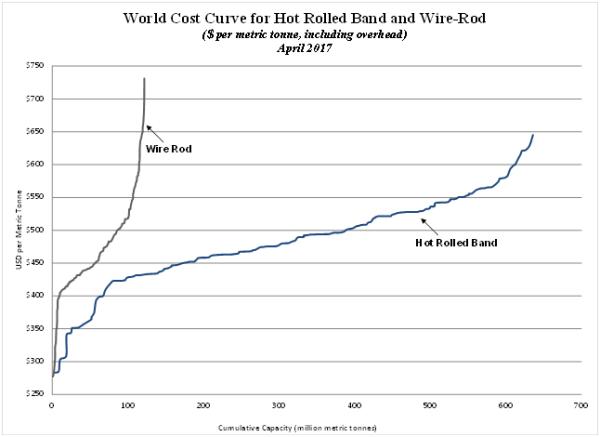

In comparing the World Cost Curve for Hot-Rolled Band and Wire Rod including overhead for 180 steel plants as of April 2017, we observe the following:

• The World Cost Curve for Hot-Rolled Band includes 180 producers, with a total capacity of 636 million tonnes and an average of 3.53 million tonnes per company. As of April 2017, the median cost was $483 per tonne.

• The World Cost Curve for Wire Rod also includes 180 producers, with a total capacity of 122 million tonnes and an average of 0.678 million tonnes per company. For the same time period, the median cost was $453 per tonne.

• The median Chinese mill’s operating cost for hot-rolled band stands at $458 per tonne and $496 per tonne for the median non-Chinese mill.

• The median Chinese mill’s operating cost for wire rod is $441 per tonne and $493 per tonne for the median non-Chinese mill.

Regarding rebar, we assume that the operating cost is $10 to $15 per tonne lower than that for wire rod. Some wire rod is highly engineered and higher-cost used for special applications. This product is made to the precise chemical and dimensional requirements of the customer.

Currently, we observe an amazing condition in China where the rebar price is $61 per tonne higher than the hot-rolled band price. The current price of rebar in China is about $465 per tonne while the domestic ex-works hot-rolled band price is $404 per tonne.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2017 by World Steel Dynamics Inc. all rights reserved