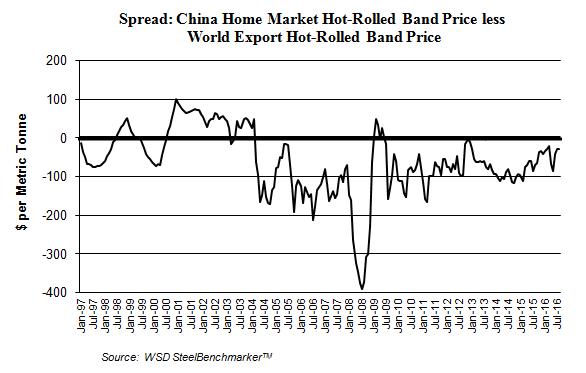

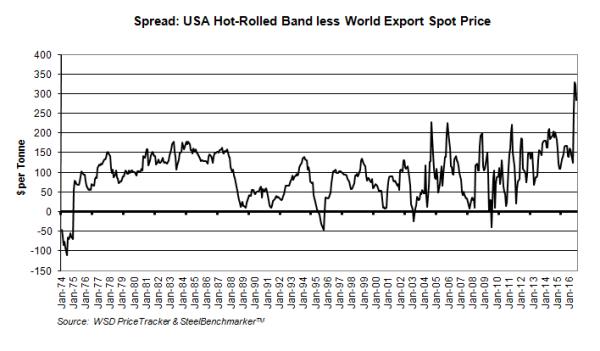

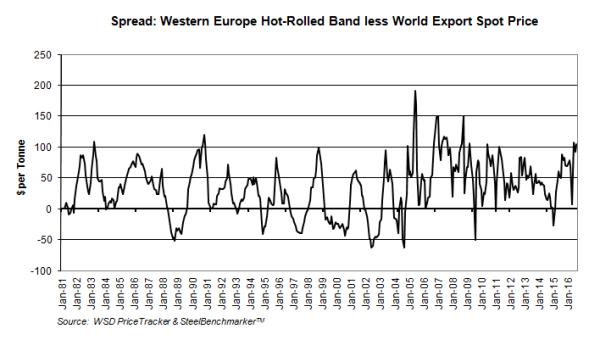

Chinese, EU and USA home-market prices versus the HRB export price

Using the database in WSD's SteelBenchmarkerTM pricing series, we've compared home country hot-rolled band prices in China, the EU and the USA to the world price, FOB the port of export. As indicated, the variation in the spreads at various points in time are often unsustainable (which will promote steel futures trading when the time is right). Interestingly, while the data is not included herein, the variation in marginal cost from country-to-country is far less than the variation in the price. Hence, the name of the game for the steel companies is to benefit from the "pricing power" in the home market.

- The Chinese ex-works price in the 2001 to 2004 time frame at times tended to be about $50 per tonne above the world price in part because hot-rolled band was in short supply. However, given the current ex-works price (not including the cost to ship the steel to the port of export) at about $359 per tonne, excluding the 17% value added tax, it's now selling at a $41 per tonne discount to the world price of about $400 per tonne.

- The USA price since 2004 has not infrequently sold at a $100 per tonne or so premium to the world price. Currently, the premium is about $260 per tonne - having briefly hit $340 per tonne about a month ago when the USA price was as much as $700 per metric tonne and the world price was about $360 per tonnes.

- The EU price for hot-rolled band versus the world export price from 1981 to 2015 was unfortunately, for the steel mills, often only about $50 per tonne higher; or, just about the cost to import the offshore HRB in Panamax vessels. In the past few months, based on the reduction in foreign offerings, including a sizable decline in Chinese offering, the HRB domestic price has climbed to $480 per tonne, or $80 per tonne above the world price. WSD thinks the spread for the EU mills will widen further.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2016 by World Steel Dynamics Inc. all rights reserved