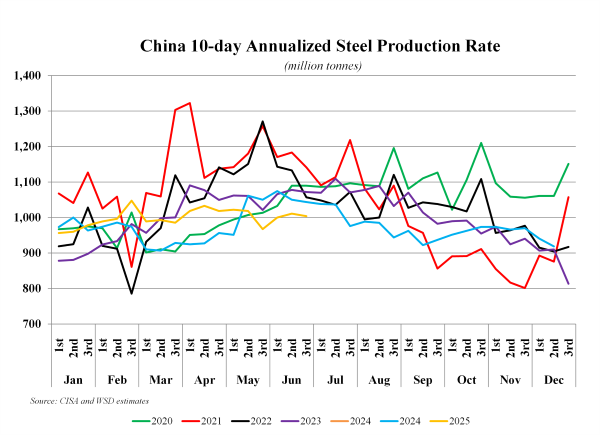

Sizable Chinese overproduction of steel during H1 2025 will “force” a massive slowdown in output during the second half. This presumes that the “edict” issued earlier this year by Chinese policymakers requiring that steel output in 2025 be reduced by 50 million tonnes compared to last year, is at least partly implemented. We assume the following:

Actual crude steel output is reduced by about 19 million tonnes to 955 million tonnes in 2025. The first 4 months of reported production this year represent an increase of 2.4% versus the same 4-month period in 2024. “High-frequency” data for June suggests output remains about flat (with April reported exactly flat y/y despite the same high-frequency data previously indicating significant y/y growth).

- As such, WSD assumes a roughly 2-3% decline in reported output for May-June, which may be an “optimistic” view compared to reality.

On this basis, the decline in H2 2025 output would have to be about 7.6% y/y to 860 million tonnes annualized compared to 948 million tonnes during the second half of 2024 and 1,091 million tonnes during the first half of this year.

Export bookings decline to 119 million tonnes this year versus 123 million tonnes of deliveries last year.

- China’s steel exports continue to rise so far this year, pressuring international markets already under duress from slowing demand ex-China. As such, and assuming the production decline above, China’s steel exports would slow to about 110 million tonnes annualized in the second half, delivering a modest y/y decline and moderately improving the global supply/demand situation. Why only “moderately?” Because, new export-oriented supply in Southeast Asia during the second half may very well offset much of the benefit from China’s slower steel exports.

Steel mills and steel end-users may have liquidated about 15 million tonnes of inventory in the first five months of 2025 – which is about 36 million tonnes annualized. Perhaps there will be an additional steel mill and steel user inventory liquidation of 3-5 million tonnes at some point this summer.

- Steel production often declines in China in late summer. In the last several years, the drop from April to September has been about 15%.