In December last year, Turkey’s total hot rolled coil (HRC) exports rose by 124.6 percent compared to November and by 164.1 percent year on year to 175,670 mt, according to the data provided by the Turkish Statistical Institute (TUIK). These exports had a value of $113.80 million, up by 130.1 percent month on month and by 157.2 percent compared to the same month of 2022.

In 2023, Turkey’s HRC exports amounted to 1.24 million mt, dropping by 14.5 percent, while the value of these exports fell by 32.0 percent to $867 million, both compared to the same period of 2022.

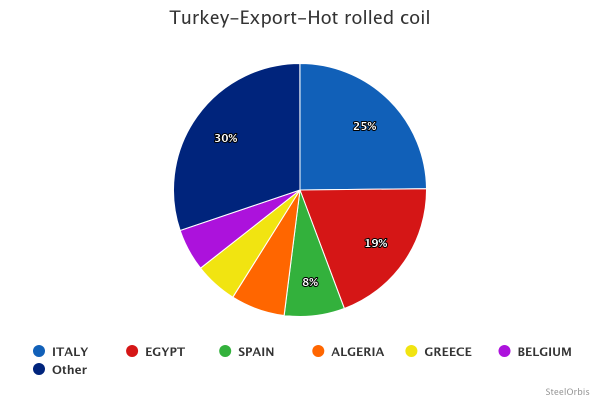

In the given year, Turkey’s largest HRC export destination was Italy which received 308,696 mt, up 8.7 percent year on year. Italy was followed by Egypt with 241,817 mt, down 5.6 percent, and Spain with 95,761 mt, up 152.2 percent, both on year-on-year basis.

Turkey’s top HRC export destinations in 2023 are as follows:

Country |

Amount (mt) |

|

|

|

|

|

|

2023 |

2022 |

Y-o-y change (%) |

December 2023 |

December 2022 |

Y-o-y change (%) |

Italy |

308,696 |

283,941 |

+8.7 |

53,416 |

3,002 |

- |

Egypt |

241,817 |

256,222 |

-5.6 |

53,734 |

32,382 |

+65.9 |

Spain |

95,761 |

37,968 |

+152.2 |

9,527 |

- |

- |

Algeria |

85,859 |

75,758 |

+13.3 |

16,373 |

2,451 |

+568.0 |

Greece |

68,143 |

107,327 |

-36.5 |

9,053 |

980 |

-99.1 |

Belgium |

67,324 |

61,667 |

+9.2 |

- |

- |

- |

Morocco |

44,465 |

43,761 |

+1.6 |

6,046 |

27 |

-77.6 |

UK |

35,008 |

25,035 |

+39.8 |

- |

34 |

- |

Macedonia |

33,464 |

22,190 |

+50.8 |

- |

5 |

- |

Albania |

29,961 |

53,718 |

-44.2 |

2,153 |

1,930 |

+11.6 |

Turkey’s main HRC export destinations in 2023 last year are as follows: