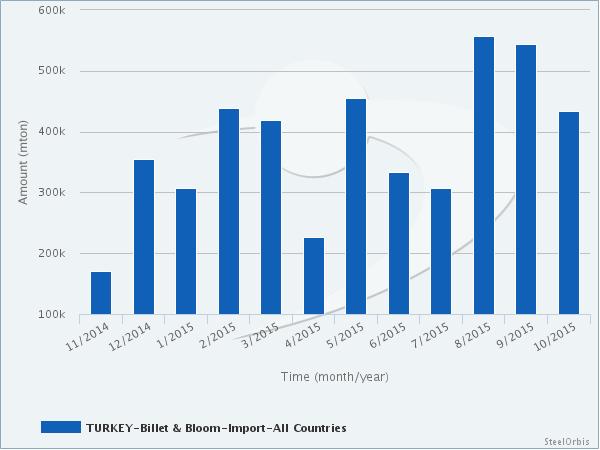

In October this year, Turkey's billet and bloom import volume increased by 156.9 percent year on year to 434,115 metric tons, down 20.3 percent compared to the previous month, according to the data provided by the Turkish Statistical Institute (TUIK). The value of these imports totaled $149.35 million, up 58.77 percent year on year and falling by 21.12 percent month on month.

In the January-October period this year, Turkey's billet and bloom import volume increased by 67 percent year on year to 4.02 million metric tons, while the value of these imports totaled $1.6 billion, up 22.7 percent year on year.

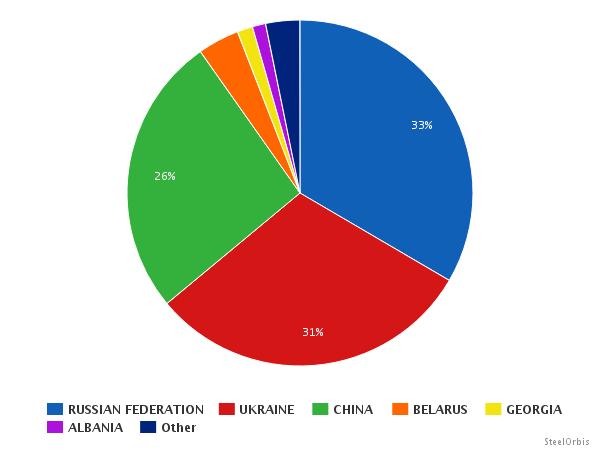

In the January-October period, Turkey imported 1,344,934 mt of billet and bloom from Russia, 68.4 percent higher year on year, with Russia ranking first among Turkey's main billet and bloom import sources, ahead of Ukraine which supplied 1,228,537 mt in the given period, down 2.3 percent year on year.

Turkey's top 10 billet and bloom import sources in the January-October period this year are as follows:

Country | Amount (mt) | |||||

January-October 2015 | January- October 2014 | Y-o-y change (%) | October 2015 | October 2014 | Y-o-y change (%) | |

Russia | 1,344,934 | 798,650 | 68.40 | 160,126 | 73,792 | 117.00 |

Ukraine | 1,228,537 | 1,257,483 | -2.30 | 17,233 | 49,468 | -65.16 |

China | 1,056,275 | 29,880 | 3435.06 | 222,767 | 10,008 | 2125.89 |

Belarus | 156,247 | 65,827 | 137.36 | 15,064 | 19,617 | -23.21 |

Georgia | 58,610 | 58,546 | 0.11 | 1,873 | 1,739 | 7.71 |

Albania | 49,696 | 80,788 | -38.49 | - | 12,966 | - |

Brazil | 36,225 | 766 | - | 15,432 | 48 | - |

Bosnia-Herzegovina | 31,724 | 30,149 | 5.22 | - | - | - |

Serbia | 22,704 | 46,650 | -51.33 | - | - | - |

Libya | 12,500 | - | - | - | - | - |

Turkey's main billet and bloom sources on country basis in January-October are presented below: