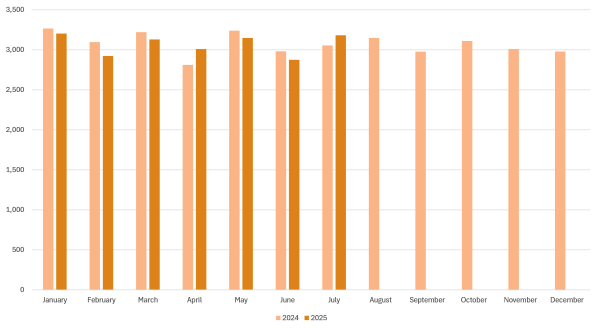

According to a statement released by the Turkish Steel Producers’ Association (TCUD), in July this year crude steel production in Turkey increased by 4.2 percent year on year to 3.18 million mt, while in the first seven months production declined by 0.9 percent year on year to 21.48 million mt. In July, Turkey’s billet and slab production amounted to 2 million mt and 1.18 million mt, up 2.1 percent and 7.8 percent year on year, respectively. In the January-July period, Turkey produced 13.65 million mt of billet, up 3.1 percent, against 7.83 million mt of slab, down seven percent, both compared to the same period of 2024.

In the given month, finished steel consumption in Turkey rose by 31.1 percent year on year to 3.64 million mt, while in the January-July period the country’s finished steel consumption increased by 1.7 percent year on year to 22.23 million mt.

In July, Turkey’s steel exports fell by 8.5 percent to 1.14 million mt, while the value of these exports decreased by 10.9 percent to $800.21 million, year on year. In the first seven months, the country’s steel exports rose by 13.9 percent to 8.80 million mt, while the value of these exports increased by 5.4 percent to $5.99 billion, both year on year. Flat and long product exports in the January-July period amounted to 3.80 million mt and 4.63 million mt, respectively, with increases of 10.2 percent and 12.8 percent year on year, while semi-finished product exports amounted to 364,036 mt.

In the seventh month of the current year, Turkey’s steel imports increased by 55.1 percent to 1.82 million mt, while the value of these imports moved up by 30.8 percent to $1.29 billion, both year on year. In the January-July period, the country’s steel imports increased by 17.8 percent to 11.08 million mt, while the value of these imports moved up by 3.7 percent to $7.79 billion, both year on year. Looking at the imported products, flat and long product imports in the first seven months amounted to 5.34 million mt and 951,240 mt, respectively, with increases of 9.9 percent and 17 percent year on year, while semi-finished product imports amounted to 4.78 million mt.

In the first seven months, Turkey’s steel export to import ratio increased to 76.99 percent, from 75.79 percent recorded in the same period of the previous year.

The 55.1 percent increase in imports recorded in July has raised serious concerns in Turkey’s steel sector. In particular, imports from China, Russia, and other Far Eastern countries under the Inward Processing Regime (IPR) have further deepened the unease in the sector. In some product categories, IPR-related imports, instead of being processed for export, are effectively directly competing with Turkey’s existing production capacity. According to industry sources, this situation contradicts the primary purpose of the IPR.

TCUD representatives emphasize that the IPR scheme needs to be reviewed urgently. Such a step is deemed crucial not only to restore the export-to-import coverage ratio in the steel industry back to 100 percent, but also to prevent trade diversion caused by imports targeting countries that have introduced additional safeguard measures following the US and EU tariffs, as well as to narrow the current account deficit.

The association reported that steel imports from China rose by 169 percent year on year in July, reaching 513,000 mt. Thus, China accounted for 28 percent of total steel imports during the month. India also ranked among the countries that stood out with increased shipments in the same period.

In the January-July period, Russia became Turkey’s largest steel supplier with a 73 percent increase and a volume of 2.6 million mt. Russia was followed by China with a 32 percent rise to 2.4 million mt, South Korea with a 32 percent increase to 1.3 million mt, and Malaysia with a 20 percent increase to 1.2 million mt.

While China exported only 390,000 mt of steel products to Turkey five years ago, imports from the country are projected to total 5 million mt by the end of 2025.

According to the association, this situation clearly shows that global steel giants facing difficulties in their domestic consumption are turning to Turkey without any obstacles. The TCUD emphasized that imports at the current levels are unsustainable and stressed the urgent need for restrictive measures to be implemented.

Turkey's crude steel production - July 2025