Among the main topics discussed in Turkey’s scrap market in 2024 were the declining demand for Turkish steel, the lack of accessible steel export markets, insufficient domestic demand, cuts in steel production capacity utilization rates, China’s negative impact on international steel prices, the availability of cheaper semi-finished steel and the weak economic performances of Turkey and the EU. Meanwhile, throughout 2024 scrap availability was on the low side and collection prices remained relatively high, in particular causing occasional problems for European scrap sellers in terms of offering attractive prices. Many market players have defined 2024 as “the year when no one made any money."

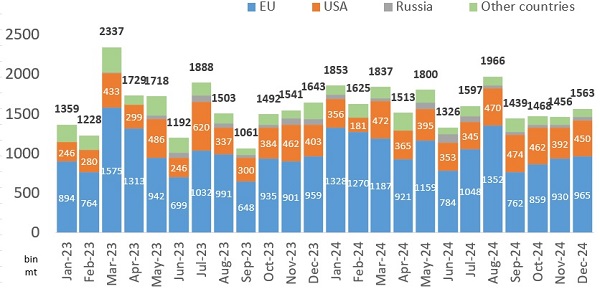

Turkey’s overall scrap imports in the January-October period of 2024 totalled 16,424,089 mt, increasing compared to 15,563,219 mt in the same period of 2023, while the overall import tonnage in the full year of 2023 was 18,775,714. The highest monthly tonnage bought by Turkey in 2024 was recorded in August, with a total of 1,966,248 mt. In January, February, May, June, August and September of 2024, Turkey’s monthly scrap imports surpassed the tonnages recorded in the corresponding months of the previous year.

Turkey's scrap imports, 2023-2024

According to the data for the first ten months of 2024, the leading scrap supplier to Turkey was once again the EU, followed by the US, with the UK occupying third place. In terms of supplier countries, the first ten suppliers of scrap to Turkey in the given period were as follows:

Country |

Quantity (M Ton) |

USA |

3,872,719 |

Netherlands |

2,228,209 |

United Kingdom |

1,773,014 |

Belgium |

947,325 |

Lithuania |

850,432 |

Romania |

745,019 |

Denmark |

737,920 |

Germany |

530,648 |

France |

503,141 |

Venezuela |

483,458 |

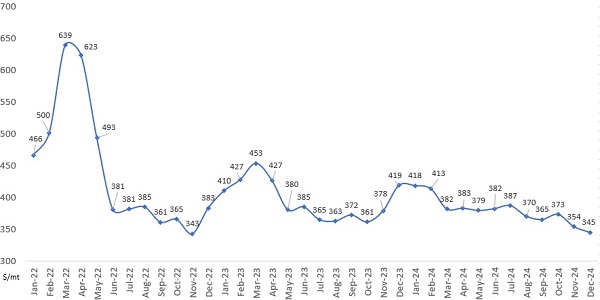

Turkey’s import scrap market had made a positive start to 2024 due to the ongoing tight supply conditions after the holidays. The highest HMS I/II 80:20 scrap price in 2024 was recorded on January 11 at $426/mt CFR. This level was a little lower than the peak price in 2023 which stood at $461/mt CFR Turkey. However, import scrap prices in 2024 mostly followed a downward trend from the start to the end of the year. As of February, deep sea scrap prices started to decline and never recovered to such levels again.

On February 2, 2024, the average HMS I/II 80:20 scrap price in Turkey was at $423/mt CFR, the same as the level recorded on the same date in 2023. In early 2024, deep sea benchmark prices in Turkey followed a similar trend to prices in early 2023, with the price trends for the two years starting to diverge on February 16.

In 2023, Turkey’s deep sea scrap prices had been impacted significantly by the massive earthquakes which hit the south of the country on February 6, leading prices to increase sharply from $423/mt CFR to $461/mt CFR within just one month. In contrast, in the same period in 2024 prices declined from $423/mt CFR to $373/mt CFR on March 7. The sharp decline in prices was the result of US suppliers’ readiness to accept lower levels. The long-awaited collapse of prices happened at the end of February. On February 28, deep sea scrap prices fell sharply in an ex-US scrap deal done at $390/mt CFR on average, below the psychological threshold of $400/mt CFR. The reason behind the price collapse was the high number of offers to Turkey, from almost all scrap supplying regions. According to sources, offers in the market totaled approximately 15 deep sea cargoes at the time. The lack of steel demand obviously caused Turkish mills to remain cautious and to be reluctant to conclude scrap deals at a quicker pace.

Between March 7 and August 14 2024, Turkey’s deep sea scrap prices remained in the range of $373-388/mt CFR. Very unusually, there was very little volatility in prices during this period. For example, in 2023 prices had moved in the range of $364-456/mt CFR in the same period. In 2022, prices had moved within a far wider range of $391-622/mt CFR in the corresponding period. It should be recalled that both 2022 and 2023 were impacted by very negative developments, by Russia’s invasion of Ukraine and then the earthquakes in Turkey, respectively. By comparison, in the March 7-August 14 period of 2021, deep sea scrap prices had fluctuated in a narrower range of $390-458/mt CFR.

Import scrap prices in Turkey, 2022-2024

In the March-August period of 2024, there were some developments that attracted attention. Turkey was getting ready for local elections on March 31, ahead of which on March 21 Turkey’s central bank increased interest rates in a surprise move to 50 percent, boosting hopes that monetary policy would be tighter in the future, but at the same time negatively impacting trading. In April, Turkish mills were feeling the heat from insufficient steel demand. In May, Turkish mills had significant leverage during negotiations with scrap suppliers due to the weakness of the steel demand they were receiving. Turkish rebar prices were still softening, while the local HRC segment was also weakening. Furthermore, no support for the scrap market was forthcoming from alternative markets such as India, Bangladesh and Pakistan. In this period, scrap supply and demand reached an equilibrium, not allowing much room to either side to drop or increase scrap prices. Purchases of cheaper import billet provided support for Turkish steel producers, who were seeking to reduce their average production costs. Towards the end of July, the use of billet for rebar production was at least $35-45/mt more advantageous compared to the use of imported scrap. Due to Turkish mills’ import billet purchases during July, they were under less pressure to buy scrap and could take a breather.

However, in August the lack of scrap demand coming from Turkey was exerting significant pressure on scrap suppliers. Deep sea prices which stood at $373/mt CFR on August 14 dropped to $355/mt CFR within seven days, a price last seen on October 28, 2023. According to SteelOrbis’ evaluations made in early August, in the previous two to three weeks China alone had sold around 350,000-400,000 mt of billet to Turkey, while, together with other ex-Asia and ex-Black Sea import billet purchases, the total transacted volume in the given period was estimated to have exceeded 500,000 mt. At the same time, Turkish mills, according to market players’ evaluations, could afford to wait at least 10 days or so before concluding new scrap purchases and so they were easily able to exert pressure on suppliers.

At first, it was thought that the average HMS I/II 80:20 scrap price of $355/mt could be the bottom level for 2024. Having fallen to this level, deep sea scrap prices then started to recover. After buying large tonnages of billet and managing to cut their scrap purchase prices, Turkish mills were more willing to accept higher price levels and replenish their scrap stocks. During September, benchmark scrap prices moved up and reached $383/mt CFR on October 11. The stimulus package announced by the Chinese government raised hopes at the end of September and perhaps caused the uptrend to continue a little longer than it otherwise would have. The return of China from its week-long holiday in October failed to provide support for the initial optimism in the market. The softening observed in Chinese futures prices after the holiday raised questions about the sustainability of upward price movements in general. Meanwhile, Turkish mills having tried to get ahead of the anticipated upward curve in early October had already completed their scrap purchases for the first half of November. With the number of sellers in the market seeking buyers starting to increase, deep sea scrap prices declined to $359/mt CFR towards the end of October.

However, the declining trend in Turkey’s import scrap market did not stop there. The previous bottom level of $355/mt CFR was breached on November 20. The average HMS I/II 80:20 scrap price first dropped to $347/mt CFR and then fell to $338/mt CFR on December 2. This price level was last seen in November 2022 (when prices averaged at $336/mt CFR Turkey). $338/mt CFR Turkey ended up being the bottom level of scrap prices in 2024, compared to a bottom level of $349/mt CFR in 2023.

Deep sea scrap prices recovered a little in December as Turkish mills tried to secure tonnages for January shipment and also a few tonnages for February shipment. With December being a short month in terms of trading and with winter conditions impacting scrap flow in supplier regions, prices increased to $350/mt CFR. However, as the holiday season started, trading halted completely in the last week of December. As a result, deep sea scrap prices looked like remaining at $350/mt CFR at the end of 2024, down $60/mt from the price at the start of the year.