US hollow structural section (HSS) distributors have been expecting a price decrease of at least $2.00 cwt. ($44 /mt or $40 /nt) to be announced by domestic tubing mills since last week. While the mills have not yet made such an announcement to all of their customers, the price decrease is imminent and some customers are already receiving offers that reflect the decrease.

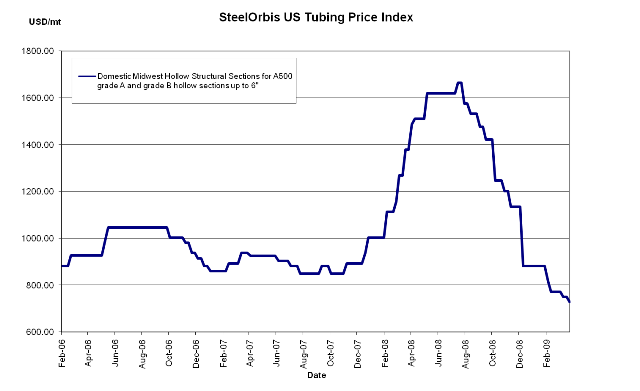

US domestic HSS prices are expected to decrease by at least $2.00 cwt., bringing most offers to the level of $32.50 cwt. to $33.50 cwt. ($717 /mt to $739 /mt or $650 /nt to $670 /nt) ex-mill, for ASTM A500 Grade A and B, up to 6". For the right quantity and specs, orders can be negotiated even below this new range.

Even after this new decline, the US tubing market is expected to trend slightly down over the next month, especially considering that the US flats market has yet to show any immediate signs of improvement.

Nonetheless, there are a couple of potential positive signs for the US tubing market moving forward: an up-tick in scrap prices and reduction in service center inventories. After shredded scrap prices fell by about $25 /lt earlier in the month, they bounced back by $10 /lt within the next week and there are signs that they will increase further by next month. Furthermore, according to the most recent Metal Service Center Institute (MSCI)'s monthly shipment and inventory report, pipe and tubing inventory decreased from about 751,000 nt, in February to about 712,000 nt in March. Furthermore, inventory overhang decreased from an estimated 4.3 months in February to about 3.8 months in March. However, daily inventory shipments actually declined from February to March, at 8,700 nt and 8,500 nt respectively, which is another indication that the demand is still weakening and we are not out of the woods yet.

On the import side, Mexico remains the most competitive foreign source offering tubing to the US, primarily due to their aggressiveness and proximity to US borders. Mexican HSS tubing offers to the US have decreased by approximately $4.00 cwt. ($88 /mt or $80 /nt) over the past couple weeks and now range from about $30.00 cwt. to $31.00 cwt. ($661 /mt to $683 /mt or $600 /nt to $620 /nt) delivered to customers in Texas and California. However, as in the case of the domestic producers, Mexican mills may be willing to accept bids below $30.00 cwt. ($661 /mt or $600 /nt) for certain attractive orders.

Meanwhile, Turkish mills have been forced to continue to offer HSS tubing to the US in the range of approximately $31.00 cwt. to $32.00 cwt. ($683 /mt to $705 /mt or $620 /nt to $640 /nt) FOB loaded truck, US Gulf Coast ports, despite an eagerness to raise prices due to their domestic up-tick. Nonetheless, Turkish mills' lead times, which are approximately three to four months, and their lack of readily available vessels currently prevent them from being a competitive player in the import tubing market.

Furthermore, licensing data from the US Steel Import Monitoring and Analysis System (SIMA) demonstrate that total import tonnage of structural pipe and tube has continued to decrease on a monthly basis, a trend which started in September 2008. Tubing imports totaled 18,583 mt in March, reflecting a 21 percent decrease from February, when imports totaled 23,573 mt, and a 54 percent decrease from the 40,596 mt imported in March 2008. Meanwhile, Canada and Mexico remained the two primary import sources in March, at 12,461 mt and 4,393 mt respectively.