Turkey’s import scrap price for HMS I/II 80:20, which is one of the main benchmark prices for the global steel industry, has taken a rather unexpected nosedive, settling much lower than initially anticipated. In its forecast for import scrap price in Turkey in April, SteelOrbis had foreseen a more gradual price decline in the segment although a steeper drop had not been excluded either. As a result, market conditions and factors combined to cause an unforeseen sharp drop in prices, by almost $40/mt in just a couple of steps, compared to early April.

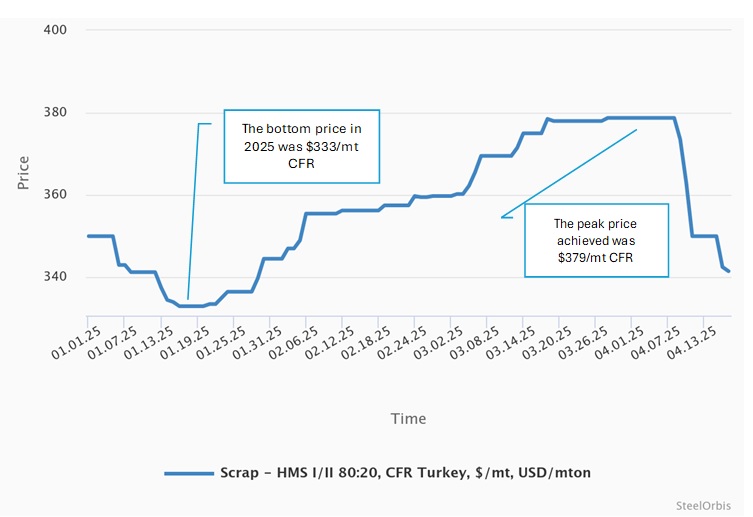

Turkey’s import scrap prices dropped from $375-382.5/mt CFR recorded on April 1 to $335-348/mt CFR on April 17, decreasing by 9.8 percent on average. The current average price at $341.5/mt CFR is a regression to late January levels, but is still $8.5/mt higher than the bottom level so far in 2025.

Sentiment was pessimistic when April started, amid increased global protectionism and the ongoing political turmoil in Turkey. As the negativity in the steel and scrap markets increased, the price trends in international scrap markets were already giving downward signals. Market sources were reporting that the local US scrap market was soft, but the European domestic scrap market still expecting some recovery inland, despite the first signals of a downward revision in exporters’ scrap collection bids.

Situation in scrap supplying regions worsens rapidly

In the weeks prior to the beginning of April, the expectation among US market insiders for April scrap prices was initially flat, later moving to soft sideways, and then to as much as $41/mt less, as supply at mills and local scrapyards was reported to be more than adequate to meet current demand levels, following the recent first quarter price increases and given the better weather as spring temperatures arrived across much of the US, market insiders told SteelOrbis. In the Ohio and Northeast US, domestic scrap prices moved down by $20-41/mt, depending on the grade.

First, exporters thought this was a domestic phenomenon, saying it would have little impact on the export segment which had already declined in line with the wishes of Turkish buyers. However, toward the second week of April, US-based exporters said they would not be able to maintain their CFR Turkey offers. Turkish mills showed little interest in import scrap, leading US-based exporters to drop their own collection prices gradually by a total of $20/mt. However, sentiments in Turkey have not changed. The first indications from the US show that another decline in the local market is expected. SteelOrbis estimates domestic scrap prices in the US will drop by another $20-30/mt when the May buy-cycle starts. This will give exporters some room to reduce their own collection prices when the time comes. Currently, scrap flow to US export yards is quite good, not creating any difficulties for US scrap suppliers.

The European market remained positive in the first week of April, but, with the significant downward pressure observed on the export side, the resistance of European scrap suppliers has also been broken. European scrap exporters had started the month with collection prices at €310/mt DAP, declining gradually to €260-270/mt DAP. In particular, the lower end of this collection price is unprecedented compared to past years. Market sources report that this level was last seen in 2022. Since then, whenever collection prices dropped to €275/mt DAP, scrap flow almost stopped.

Sub-collectors in European reported that domestic buyers start to react to this drop in the second week of April. The appreciation of the euro against the US dollar created difficulties for exporters. For a moment, sources thought ex-EU scrap prices might not fall further. However, inventories at European export yards are now quite high. Market players report that several EU-based scrap suppliers have two cargos available for export for May shipment. Some export yards have started to voice aggressively low quotations to slow down flow to their yards, while others have accepted significant price cuts in their sales to Turkey to maintain cash flow. SteelOrbis observes that the situation in the EU is harder for sellers because they are squeezed between low sales prices, the lack of scrap flow to their yards as collection prices drop, and the euro-dollar exchange rate.

Competitive billet prices strongly impact import scrap price expectations

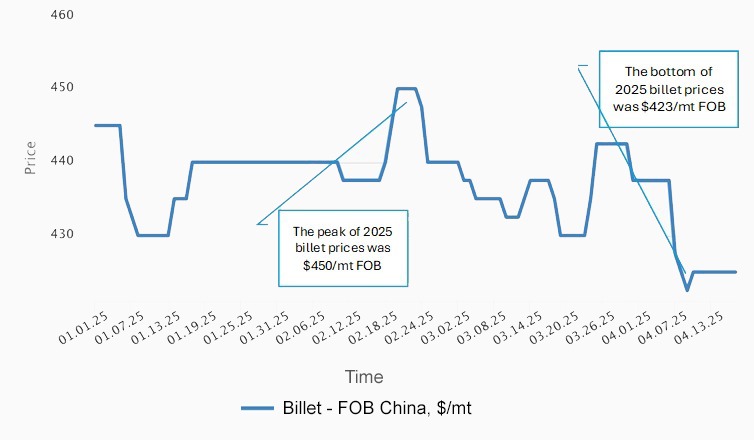

The trade war accelerated in April, putting more pressure on ex-China steel prices than expected. In particular, while in late March most market sources expected Chinese billet prices to fluctuate in the range of $430-450/mt FOB, by mid-April prices have already fallen to $415-420/mt FOB in some deals. Though some believe that the continued downtrend, as opposed to stabilization and a gradual rebound, has also been triggered by high production in March and early April and the lack of strength of local demand, the main factor - an unexpected one - remains the trade war. The US and China have slapped huge tariffs on each other, with the US imposing potential 245 percent tariffs on China. Market sources still hope that a demand rebound in China will lead to some improvement by the end of April, but any improvement may be mild and will depend on announcements from the US and expected stimuli in China.

As a result, in the first half of April, Turkey’s import billet prices have become even more competitive and by mid-month they have shifted from $475-495/mt CFR levels to $455-475/mt CFR in the latest indications, based on the SteelOrbis daily prices. Moreover, at least 100,000 mt were booked from China at $457-460/mt CFR levels, while domestic billet production costs from scrap at $375-380/mt CFR (valid up until April 8) are estimated at $530-535/mt. In the domestic market, Turkey’s billet prices stood at $500-525/mt ex-works with deals done by Kardemir and some Iskenderun region-based suppliers within this range. By mid-April, the difference between average domestic and import billet prices exceeded $45/mt, which is quite significant.

The situation in the rebar segment was also not so supportive since in the domestic market the workable levels declined by around $15/mt since early April, while export prices still lacked strength to remain at high levels while scrap prices were softening and while competition with North African suppliers remained tough. In particular, rebar prices immediately followed the drop in scrap prices, falling by $20-25/mt to $550-570/mt FOB and are set to fall even further.

Situation in iron ore and coking coal segments

Following weaking steel futures and spot prices, iron ore prices have also retreated, more than had been expected by analysts. Iron ore prices in China fell to their lowest level since September 2024 on April 8-9 - softening to $95.65/mt CFR, while expectations for April were mainly at $100-105/mt CFR. Though overall steel production in China was on the rise in April 1-10 and demand has improved, market sentiments are still having the main impact, driven by the tariff war, not by fundamentals. As iron ore port stocks have been sliding amid increased demand, market sources believe that by the end of the month iron ore prices will return to $100-102/mt CFR, though still remaining lower than expected for one of the best months in the year in terms of demand.

As for coking coal, the price trend has reversed and ex-Australia premium hard coking coal prices have finally increased - to $189/mt CFR in the latest deal in mid-April, versus $170/mt FOB in late March. This was due to supply concerns as operations at two major Australian mines have been halted in April after accidents. Further rises before the end of the month are expected to be slow and not more than $5/mt, as overall demand has remained limited and China’s buying has been focused on cheaper coking coal.

Tariff war reaches another level, directly impacting global trade

When April was starting, the uncertainties about a potential tariff war was raising concerns in Turkey’s steel and scrap markets. Market players were cautious and wanted to see what Trump would decide in relation to Turkish products. There were somewhat positive expectations, particularly for the flat steel segment. Little support was anticipated for long steel sales from the imminent tariffs and reciprocal taxes.

Hopes of negotiations before a greater trade war started were already shrinking after Trump threatened China with an additional 50 percent tax if China did not withdraw its 34 percent tariff increase for ex-US products. With the conflict between the two leading economies escalating through April, tariffs were raised rapidly, increasing risks for international supply chains and consumer prices.

| Country | Tariff rate on each other’s goods | Effective date |

| US | Up to 145% on Chinese imports | April 9, 2025 |

| China | Up to 125% on US imports | April 12, 2025 |

The US did not stop with China and announced tariffs for other trading partners, some of which retaliated against the US tariffs. In the end, the US announced a reciprocal tariff for Turkey on April 5, excluding steel and aluminum:

| Tariff Rate | Effective date | Scope | Context |

| 10% | April 5, 2025 | All imports from Turkey | Part of a universal tariff imposed on all countries under the so-called "Liberation Day" economic agenda. |

| Potential additional tariffs | TBD | Specific goods (e.g., eggs) | The US has proposed tariffs that could affect imports of certain products from Turkey, such as eggs, which may impact domestic prices. |

US President Donald Trump’s announcement of 25 percent tariffs on foreign steel and aluminum imports on February 10, which had been applied to the products from trading partners with duty-free exemptions or tariff-rate quota deals, including Canada, Mexico, Australia, Argentina, Brazil, South Korea, the EU, Japan and the UK, that got effective as of March 12, 2025, leveled the field for Turkey. Turkish steel was already under a 25 percent tariff in the US under the scope of Section 232 since 2018.

Turkey faces its own challenges regarding economy and trade

Impacted directly or indirectly by the ongoing trade war, Turkey has been monitoring developments in relation to the wave of protectionism around the world. Turkey’s exports have been hit by the new quota regime announced by the EU, reducing its exports to the region drastically for some products. In addition to reduced export demand, Turkey’s domestic steel market has also been sluggish. When April started, there was hope for a recovery in the local long steel demand, particularly for rebar sales. With the spring starting in Turkey, Turkish mills were hoping for the construction sector to accelerate and that demand for rebar and structural steel would increase. Unfortunately, such hopes were disappointed in the first half of April. The political turmoil in the country that started on March 19 also took its toll on the steel sector.

According to Bloomberght, the decrease in the foreign currency reserves of the Central Bank of the Republic of Turkey (CBRT), which began after March 19, continued last week as well. According to the CBRT data, gross reserves fell from $154.3 billion to $147.5 billion during the week ending April 11. Net reserves also declined, dropping from $48.7 billion to $38.9 billion in the same week. The decline in net reserves excluding swaps also continued. As of the week ending April 11, net reserves excluding swaps stood at $20.8 billion, down from $31.1 billion the previous week. Since March 19, net reserves excluding swaps have decreased by $44.6 billion. The CBRT has reacted in this situation by increasing the policy rate - the one-week repo auction rate - from 42.5 percent to 46 percent on April 17. It also raised the overnight lending rate from 46 percent to 49 percent and the overnight borrowing rate from 41 percent to 44.5 percent.

According to market sources, such interest rates are also obstacles for trading, and holding high inventories at warehouses does not make sense for traders. Having entered the second half of April, all Turkish sources agree that the impact of the global trade war has been limited but economic developments specific to Turkey are the main problem. Maintaining a wait-and-see stance, Turkish mills are focused on gaining a clearer picture of their steel sales before buying deep sea or short sea scrap. It is also worth mentioning that the recent price hikes for electricity and natural gas, 10 percent and 20 percent respectively, have caused Turkish mills’ production costs to move up, by an estimated additional $7-10/mt for a medium-sized producer, depending on their production rates. With no hope of passing this additional cost on to their buyers, Turkish mills have instead been forced to drop their rebar sales prices over the past two weeks.

Conclusions

SteelOrbis’ estimation for the average HMS I/II 80:20 scrap price for the end of April was $368/mt CFR, while mentioning the possibility of a steeper decline in prices. However, with sentiments worsening by each day, the deviation between current prices and our estimation has increased.

Due to such developments, Turkey’s deep sea market is showing very little potential for a recovery. Market sources report that that the bids received from Turkish mills are moving down in each negotiation. While Turkish mills’ lack of interest in scrap is giving them room to test the water, cuts in capacity utilization rates are increasingly likely, and as the current week ends more and more players are pointing to this possibility.

If Turkish producers lower their production rates, deep sea HMS I/II 80:20 scrap prices may move down towards $320/mt CFR. Depending on the cuts or possible declines in steel prices, scrap prices may hit an even lower bottom before a balance is reached between steel and scrap prices. Considering the current import billet offers to Turkey, scrap at $320/mt CFR may balance the production costs for Turkish mills, unless domestic rebar prices decline further in the second half of April. Most market players believe Turkish mills would like to wait for the SteelOrbis Spring 2025 Conference & 92nd IREPAS Meeting in Athens on April 27-29 before making decisions.

On the other hand, Turkish mills may want to maintain their scrap tonnages, which would lead them to start buying more cargoes starting in the coming week. While this is considered to be a slim possibility, in this case deep sea scrap prices are expected to stabilize in the range of $330-340/mt CFR. Due to the high scrap availability in scrap supplier regions, higher price levels may not be reached before the end of April.

Due to the rapidly changing tariffs and rules regarding international trade as well as countries leaning towards more protectionist stances, radical scenarios may further impact the global scrap market in the coming period.