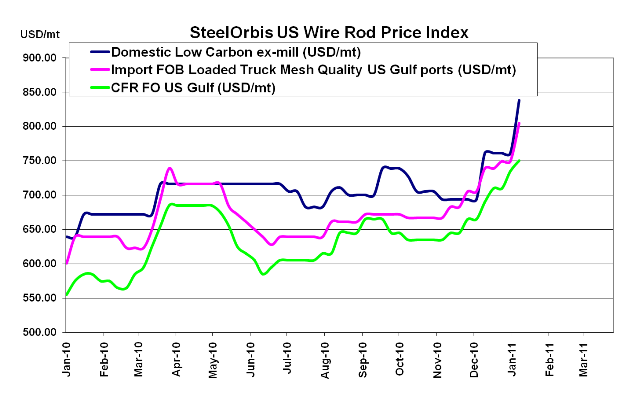

Spot prices for US wire rod are spiking, even before a reported $75/nt price increase takes effect with February shipments.

Last week, expectations for scrap price increases varied upward as the week progressed, rising from $40-$50/lt to $60-$70/lt for shredded. Earlier this week, when pricing became official, many in the US wire market expected the $65/lt increase in shredded scrap to directly translate to wire rod price increases. However, at least one mill has raised the stakes. On Tuesday, Nucor made it known to customers that prices for February shipments will include a $3.75 cwt. ($83/mt or $75/nt) price increase, and while other mills usually follow, they will at least raise prices by $3.25 cwt. ($72/mt or $65/nt).

Taking this into account, spot prices for wire rod have already firmed up substantially, with most customers paying $37.50-$38.50 ($827-$849/mt or $750-$770/nt) ex-Midwest mill-an increase of $2.00 cwt. ($44/mt or $40/nt) from last week. Official mill asking prices for February, which will rise up an additional $1.75 cwt. ($39/mt or $35/nt) to meet the full $3.75 cwt. increase, are expected to pass through for the most part. Scrap's momentum, combined with slowly stabilizing demand for wire rod, could very well bring prices over $40.00 cwt. ($882/mt or $800/nt) ex-Midwest mill in the not-so-distant future.

As for imports, Turkish mills also raised prices as a reaction to both US price increases and their own rising raw material costs. Compared to import offers last week, current offers are about $2.50 cwt. ($55/mt or $50/nt) higher, but prices are still lower than US offerings, settling in the range of $36.00-$37.00 cwt. ($794-$816/mt or $720-$740/nt) duty paid FOB loaded truck in US Gulf ports. However, once the full US price increase takes effect, it is unlikely that Turkish mills will match with another significant price hike of their own. SteelOrbis has learned of several import inquiries and transactions taking place in the current market, and it is in Turkish mills' best interest to keep that momentum going with comfortable margins between US import and domestic prices.