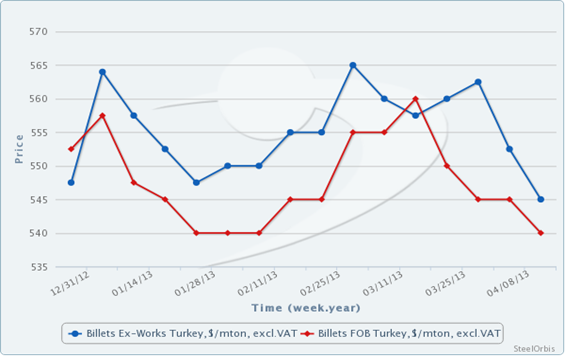

Domestic billet prices in the Turkish market have declined by $5-7/mt since last week to $533-545/mt ex-works, while export billet offers can be found at $530-540/mt FOB, indicating a decrease of $5/mt over the same period, though demand has remained on the weak side in the foreign markets.

Meanwhile, no new billet transactions have been heard in the domestic market, after sales of 88,000 mt of billet by Kardemir, which dropped its prices to $533/mt ex-works this week. In the meantime, market players report that a few rolling mills have concluded ex-Ukraine deals at $527-528/mt CFR for 5,000-8,000 mt of billet in total, as per the latest indications.

Scrap prices have now finally declined to Turkish steelmakers' expected levels, and so it is thought that this may slow down billet purchases from the CIS. Billet needs have been met from the CIS for a while now, thereby reducing demand for domestic production billets. However, if the expected slowdown in purchases from the CIS happens, this may limit decline margins in the Turkish billet market.