In addition, some Turkish mills are expected to start maintenance works next week, which will likely reduce availability further, and this situation has been reflected in higher prices on the traders' side. However, market sources indicate that increased prices have not resulted in improved demand. Thus, demand for traders' offers has remained moderate, and the ongoing decrease in scrap prices and the adverse outlook for the market have been hindering the Turkish rebar market from registering an improvement in demand.

As of today, May 30, traders' rebar offers in the Turkish domestic market are as follows:

Region |

Dimension |

Price (TRY/mt) |

Price ($/mt) |

Price changes 27.05.2013 |

Marmara |

8 mm |

1,310 |

594 |

+5 |

Marmara |

12 mm |

1,290 |

585 |

+5 |

Iskenderun |

8 mm |

1,305 |

591 |

+5 |

Iskenderun |

10 mm |

1,295 |

587 |

+5 |

Iskenderun |

12 mm |

1,285 |

582 |

+5 |

Izmir |

8 mm |

1,295 |

587 |

+5 |

Izmir |

10 mm |

1,280 |

580 |

+5 |

Izmir |

12 mm |

1,270 |

576 |

+5 |

Karabuk |

8 mm |

1,310 |

594 |

0 |

Karabuk |

12 mm |

1,300 |

589 |

0 |

All prices are ex-warehouse and on actual weight basis. The TRY prices include 18 percent VAT, while the US$ prices exclude VAT.

$1 = TRY 1.87

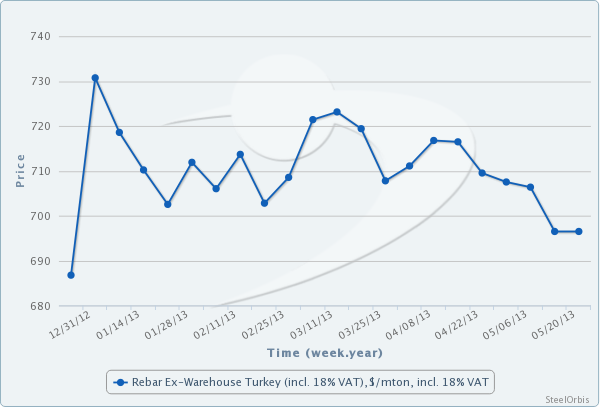

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.