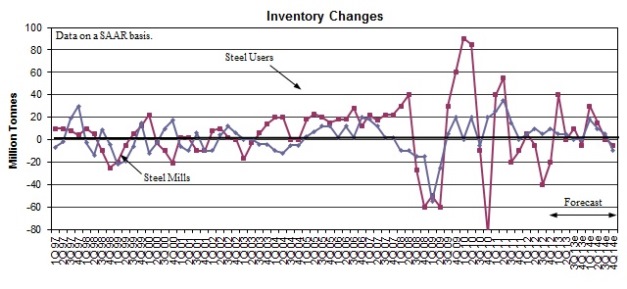

At WSD, on a global, Chinese, Advanced Country and Rest of World basis, we estimate by quarter the inventory change at the steel mills and for the steel buying community (middleman companies and end users). While the actual figures in inventory changes are never published, nevertheless we think that estimates of what's happened provide deeper insights than would otherwise be the case into the factors driving the evolution of steel production and shifts in the steel mills' "pricing power."

For example, in the second half of 2008 and the first quarter of 2009, both the steel mills and users pared their inventories; the mills needed cash because production had plummeted so severely, while steel middleman companies and users had excessive inventories to begin with - just coming out of a steel shortage period - and they perceived that holding on to inventory was a losing proposition because prices were falling.

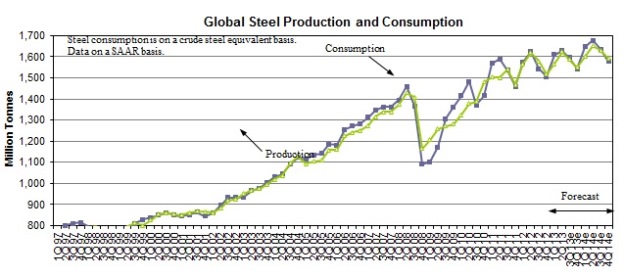

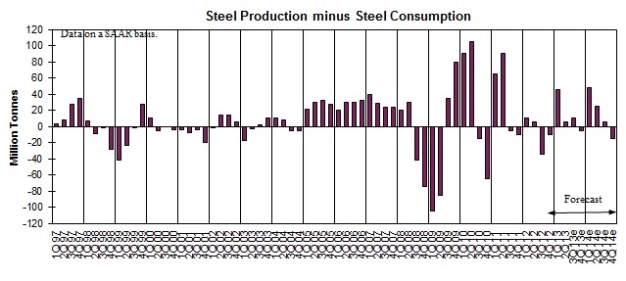

In 2013, after adjusting for inventory changes, we estimate that real global steel consumption may rise only 0.7 percent, which compares to a 2.0 percent rise in steel production. In 2014, we estimate that global real steel consumption may rise by 2.4 percent, which would be about in line with the increase in steel production.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2013 by World Steel Dynamics Inc. all rights reserved