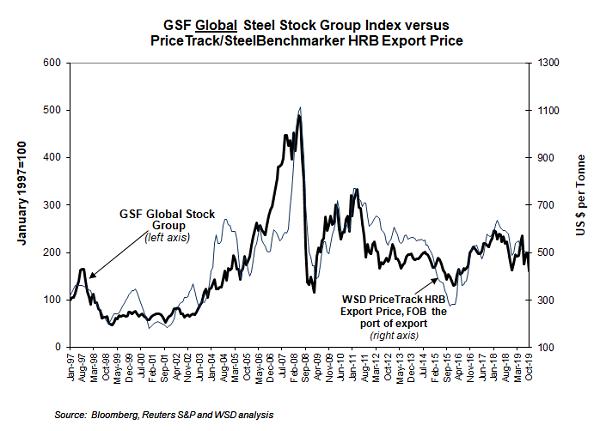

In the accompanying exhibit, the WSD Global Steel Stock Group index has a high of 600 and a low of zero (see left axis), while the index for the HRB export price ranges from 1300 to 100 (see right axis). Hence, given that the prices tend to move together, the export price often moves twice as fast as the Global Steel Stock Group price. The Global Steel Stock Group is a composite of the steel stock prices in the USA, Asia, Japan, China, Europe, Russia and Latin America. This composite had a high of almost 500 in mid-2018, when the world export price rose to about $1,100 per tonne; and then fell to just 125 in late 2008, when the HRB export price had plummeted to only about $350 per tonne.

As indicated, steel product price volatility and steel company common stock volatility is prodigious. This unfortunate circumstance is why many steel companies have a relatively low enterprise value.

For sure, the need to hedge the steel price risk for the steel mills, their customers and suppliers is overwhelming. Once liquid steel futures curves exist, this factor will work greatly to the benefit all.

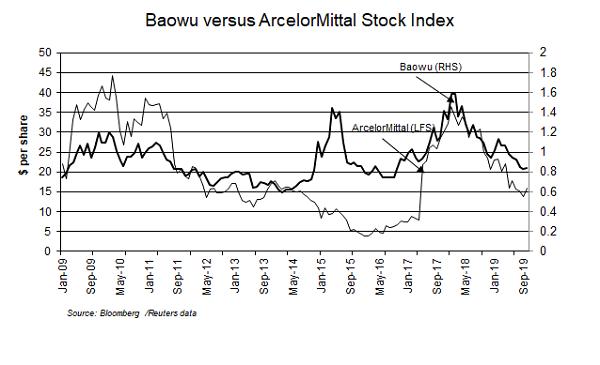

When we observe the common stock prices of Baowu, China’s largest steel company, and ArcelorMittal, the world’s largest steel company, both are about equally price volatile. In 2016, when the ArcelorMittal price plummeted so severely, it was bargain-priced versus Baowu (Baosteel at the time). Baowu is in the midst of an acquisition spree that will cause its size to far exceed ArcelorMittal’s. In the Asian world, size is king.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2019 by World Steel Dynamics Inc. all rights reserved