In recent years there has been significant discussion centered on the vast increase in steelmaking capacity in the United States. In some instances, the phenomenon has been labeled creatively as “Steelmageddon” and most recently as a “Sheet Storm,” implying potential oversupply as a result of these additions. Perhaps the contrarian viewpoint might be that these capacities could well be absorbed without causing much, if any, distress to the long-term market balance.

The improved global competitive position of the U.S. steel industry is a story that is decades in the making. A large part of this story revolves around disruption by up-start steelmakers and the dismantling and re-organization of the industry’s former bellwethers. These shifts are not merely changes in technology – a replacement of the traditional BF-BOF facilities with the EAF process route – rather, they represent a geographic, managerial, and cultural “upheaval” of the U.S. steel industry. While it may be true that the near-term outlook for the USA market might appear relatively bearish for late-2023 and possibly early-2024, especially compared to the unprecedented boom years of 2021-2022, the longer-term outlook could be viewed as structurally sound and surprisingly optimistic. The broader, longer-term prospects of the US economy are the catalyst for the improved outlook for key steel-consuming industries, including construction, manufacturing, and automotive sectors.

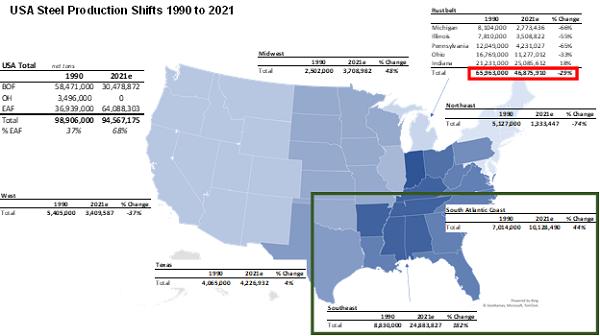

First, it’s important to point out that the transition from BF/BOF production in the USA to EAF-based output located predominantly in the Southeast of the country is not a “new” phenomenon by any stretch, in other words, capacity displacement has been underway for some time without necessarily causing overcapacity and margin pressure:

- In 1990, the “Rustbelt” states accounted for nearly 66 million tons of U.S. steel production, representing approximately 67% of total output. By 2021, the figure has dwindled to 46.9 million tons, while steel production in the Southeast and South Atlantic Coast regions increased by about 20 million tonnes during this period.

- During this 30-year stretch, all of the new capacity added in the U.S. south has been EAF steelmaking, while the vast majority of closures has been BOF facilities. As a result, EAF steelmaking as a share of overall U.S. production has soared from 37% to an impressive 68%.

This production transformation has transpired against the backdrop of arguably stagnant steel demand when viewed through a long-term perspective: Apparent consumption in 2021-2022 at an average of about 111 million tons and in 2015, also at 111 million tons, is little changed when compared to the figure nearly thirty years prior – at about 110 million net tons in 1995.

In summary, reflecting on the recent past, the USA industry has managed to add over twenty million tonnes of new capacity into a market with largely stagnant demand, all the while industry profitability has risen, on average. Factors supporting sustained profitability over the last 7-8 years have included: a) industry consolidation – there are currently four major sheet producers accounting for ~85% of U.S. production versus more than a dozen in 2000; b) increased trade protection, a slew of anti-dumping/countervailing duty cases followed by the implantation of Section 232 has succeeded in “leveling the playing field; and c) the shift of the U.S. industry to nearly 70% EAF production has shifted the operating model of the industry to a leaner, more consistently profitable methodology.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non -public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2023 by World Steel Dynamics Inc. all rights reserved