WSD views this decade as a “race to the starting line” for global steel industry decarbonization; steeper and more difficult reductions will be required in the following decades to progress towards the IEA’s and others’ 2050 net-zero targets.

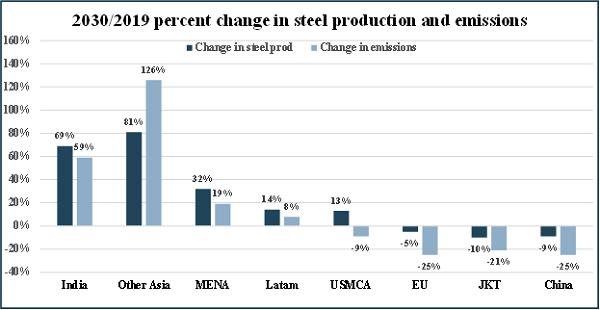

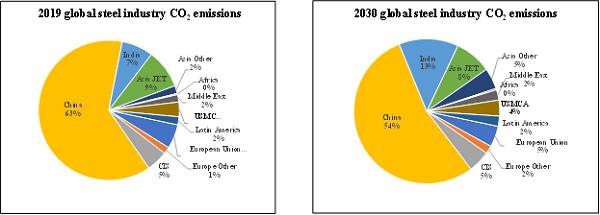

- WSD expects global steel industry CO2 emissions to decline 13% from 3,500mt in 2019 to 3,055mt in the 2030 in the base case. In this scenario, CO2 intensity decreases from 1.87 to 1.59 kg per ton of crude steel (kg CO2/tCS).

- Reduced BF/BOF production and increased EAF production in China are the main drivers of global emissions reduction together with increased EAF production growth and BF/BOF route decarbonization progress globally.

-

- India and Southeast Asia’s BF/BOF growth may exceed China’s decline after 2030.

-

- Among the regions increasing steel production, only the USMCA projects lower total CO2 emissions as EAF production share grows from 68% to 82%

- The global excess capacity problem is expected to worsen this decade. Capacity additions increase the self-sufficiency of net importing regions, reducing inter-regional import “demand”; net exporting regions’ exporting capacities increased due to reduced domestic demand: new, low-carbon-intensity steel capacity is likely to enter the market faster than “old steel” capacity is retired.

- Despite impact advancements at individual plants, “new” technologies will not have a significant impact until after 2030 due to slow progress in scaling and commercialization, particularly of Carbon Capture Use and Storage (CCUS).

-

- CCUS and other transformational technologies may not reach commercial “take off” until the second half of the 2030-2040 decade.

- EAF production costs surge ahead of BF/BOF costs. Ore prices weaken on reduced China demand; the global scrap market tightens leading to higher prices compounded by increasing costs of collecting and sorting/processing obsolete scrap.

-

- WSD expects a 5 million tonne increase in total scrap and iron ore consumption between 2019 and 2030 despite a 45 million tonne increase in steel production as the proportion of scrap increases.

- Global DRI production reaches 174mt. WSD believes that many of the announced projects in the EU and elsewhere will be delayed or deferred until after 2030 due to engineering and construction constraints, permitting timelines and high operating costs.

-

- Natural gas is expected to remain the primary reductant this decade.

-

- DR pellet supply in 2030 is expected to be tight, but not in shortage as supply increases and BF pellets can more readily be used as substitutes.

- Inter-regional steel trade is expected to decline and channelize along carbon and geopolitical axes. The EU CBAM (Carbon Border Adjustment Mechanism) is unlikely to be replicated by other regions, though “CBAM-light” versions are expected to arise. Reshoring trends notwithstanding, indirect steel trade may increase due to higher regional steel prices from direct steel trade restrictions (leakage).

- WSD believes that “green steel premiums” are unlikely to persist for more than a few years as more producers develop comparable low emission steel products and as the costs for producing these products decrease relative to high emission steels with carbon taxes.

- Capital needs are likely to increase, and continuing government support is uncertain.

- Availability of “green” electricity will significantly lag demand. Some could argue, WSD included, that the “problem” of reducing CO2 emissions from the steel sector is really an energy sector “problem” as the real-world constraint to decarbonizing steel is tied to the availability and cost of “green” electricity and other forms of energy, including hydrogen.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non -public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2023 by World Steel Dynamics Inc. all rights reserved