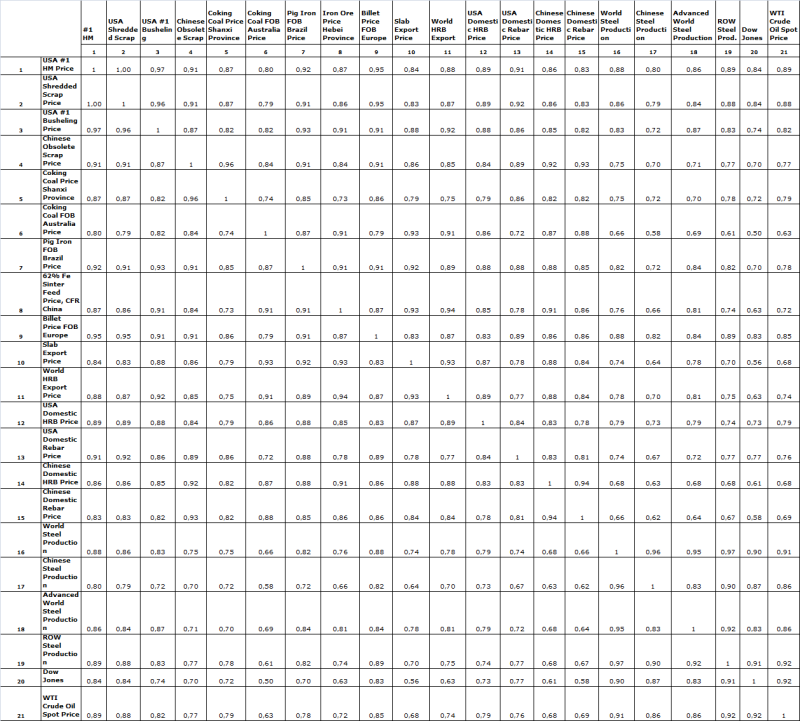

WSD's correlation matrix includes coefficients for 21 data sets that cover steel industry prices, production figures and macro-indicators. From the table below, it becomes apparent that price movements among related or supplemental items have strong, direct relationships. For example, the various USA scrap grades (or scrap prices and pig iron) have very high correlation coefficients. And, items such as the world export prices for slab and HRB as well as the price for domestic Chinese HRB all share high correlation coefficients with the 62 percent Fe sinter feed, delivered to China price.

Crude steel production on a regional and global basis has high correlation coefficients with certain economic indicators. Traditionally, WSD has viewed steel as a late in-cycle industry because steel consumption is largely a function of fixed asset investment (FAI). WSD's FAI Flywheel concept assumes that the bulk of fixed asset investment--i.e., construction and capital spending--activity that's underway at present is based on investments initiated in earlier quarters. World steel production has a coefficient of 0.91 with the crude oil price and 0.90 with the Dow Jones.

For additional information on WSD's services, please contact us at:

wsd@worldsteeldynamics.com

Or visit our website at:

www.worldsteeldynamics.com