Steel "patterns" no longer in phase with "Old Continuum"

New era

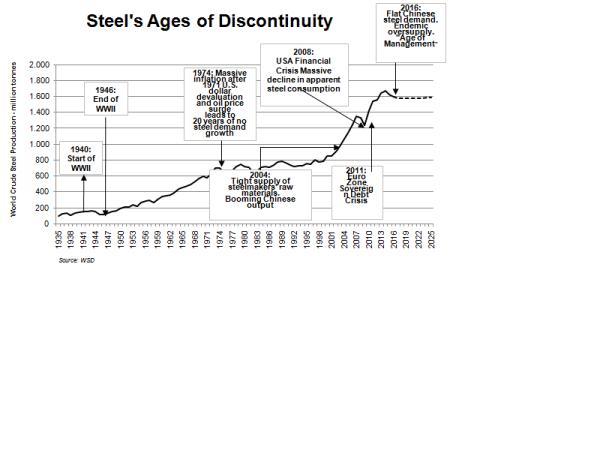

When the steel industry is in a period of profound change in its industrial structure in response to extremely adverse, and perhaps one-time, events, it enters what WSD calls an "Age of Discontinuity." During this period, the pattern of events no longer is in sync with those in the past few years; or, what one might call the "Old Continuum." During this period of violent change, the industry makes the transition to a "New Continuum."

Steel's three most recent Ages of Discontinuity occurred in:

- Second half of 2003: The industry shifted from the Old Continuum marked by slow-growth, recurring pricing death spirals, low-profit-margins, a rising number of steel mills in financial distress (including bankruptcies) and sharply increased M&A activity.

It shifted to a New Continuum that included high global steel production growth (due largely to the explosive rise in Chinese steel demand), inadequate steel production in part due to shortages - price spikes - for steelmakers' raw material, home-country steel prices rising faster than costs despite the surge in costs and a substantial rise in steel mill profits.

- Second half of 2008: The Old Continuum ended with the extreme collapse of apparent steel demand. From the second quarter of 2008 to the first quarter of 2009, non-Chinese steel production fell 35% and Chinese steel production from Q2 to Q4 of 2008 declined 21%. Thereafter, Chinese steel production rose sharply to a major new high as the government promoted a massive rise in infrastructure projects - with apparent demand rising about 290 million tonnes in the next few years. However, non-Chinese apparent steel demand never got back to the annualized peak in the second quarter of 2008. In the first quarter of 2016, Advanced Countries steel output was still down 14% from the peak in the second quarter of 2008 - lagging in part because of the surge in China's steel exports the past few years.

- Mid-2015 to the first quarter of 2016. A new continuum is evolving that will be marked by declining Chinese steel production, substantial excess capacity, moderately growing steel demand outside of China, low prices for hot-rolled on the world market (although it will remain highly price volatile), often-reduced prices for steelmakers' raw materials, a fairly strong dollar, intense M&A activity, declining ECO-Capacity for steelmaking globally, an improving competitive position for EAF steelmakers due to lower steel scrap prices, and growing steel industry protectionism and mercantilism that permits home-market steel prices in a number of countries to be relatively higher over the steel cycle versus the world price than in the past. Given the numerous forces driving changes in the steel industry's structure and steel's high price volatility, the stage is set for well-positioned and astutely-managed steel companies to turn in a good financial performance - and, to be included among the list of "winners."