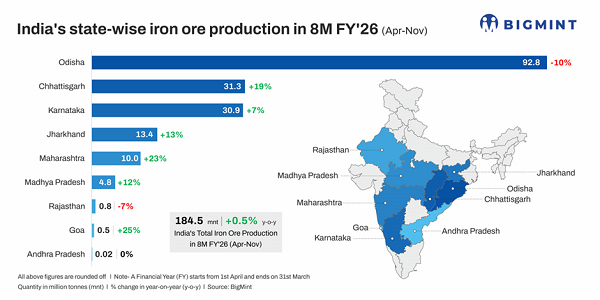

India's iron ore production rose a mere a 0.5 percent year-on-year in April-November 2025 to 184.5 million mt, according to provisional data maintained by BigMint.

Throughout the given period, iron ore production growth has lagged behind that of crude steel output, which increased at 11 percent year-on-year to 109.5 million mt. This has created a supply shortfall, especially of high-grade ore, leading to elevated prices and operational challenges for manufacturers of downstream products such as sponge iron and steel.

Consequently, India's imports of iron ore fines/lumps have increased by 126 percent year-on-year to around 7 million mt.

Odisha, the leading iron ore-producing state, recorded a decline of 10 percent year-on-year, as leading miners from the state, including the Odisha Mining Corporation (OMC), JSW Steel, and Rungta Mines, experienced challenges in boosting output. Lower output from Odisha has been the primary contributor to the slower production growth in India, as most other major hubs registered double-digit growth.

Notably, production by captive miners was down by 1 percent at 67.5 million mt. Conversely, merchant miners' output increased by 1 percent year-on-year.

State-wise iron ore production

Iron ore production from Odisha dropped by 10 percent year-on-year to 92.8 million mt, accounting for 50 percent of India's total output against 56 percent in the year-ago period.

Chhattisgarh recorded strong growth of 19 percent to 31.3 million mt, while Karnataka's production increased by a slower 7 percent year-on-year to 30.9 million mt.

Production from Jharkhand, Maharashtra, Madhya Pradesh, and Goa increased by 13 percent, 23 percent, 12 percent, and 25 percent respectively.

Besides Odisha, Rajasthan was the only state to register a decline in volumes of 7 percent.

Factors influencing India's iron ore production

OMC's production falls by 5 percent: An extended monsoon disrupted OMC's mining operations, causing a 5 percent drop in production to 20.2 million mt. Elevated stocks and weak downstream demand at the beginning of the financial year also prompted moderation in output.

However, the pace of production seems to have increased in October-November, given that the 5 percent drop is lower than the 13 percent decline recorded in the first half of 2006 fiscal year.

JSW suffers steep 32 percent drop: JSW Steel's production stood at 11.2 million mt, a sharp 32 percent decrease year-on-year. This was due to the surrender of its Jajang mines in Odisha due to cost pressures, while delays in the operationalisation of freshly secured mines seem to have prevented the steelmaker from raising its output.

Notably, JSW Steel has imported around 6.6 million mt of iron ore, possibly to make up for the production shortfall.

NMDC's production surges: A 21 percent increase in production to 31.5 million mt by NMDC, India's largest iron ore miner, helped lift the country's total output. It should be noted that NMDC experienced operational disruptions in the last fiscal due to labour strikes, leading to a low base.

In fiscal year 2026, NMDC has set a target of 55.4 million mt, the entirety of its environmental clearance (EC).

Lloyds' output jumps amid major capacity expansions: Lloyds Metal and Energy Limited raised its production by 27 percent to 9.8 million mt amid major investments in capacity expansion. For example, in late June, Lloyds announced it has secured an EC to expand its mining capacity to 55 million mt/year.

Production from other major miners declines: Among other major miners, Rungta Mines' production fell by 23percent to 10.8 million mt. Vedanta and ESL's output fell by 15 percent to 6.7 million mt, while AM/NS's production was down by 18 percent at 6 million mt due to a monsoon-driven slowdown. Meanwhile, Tata Steel's production remained unchanged year-on-year in the first 8 months of fiscal year 2026, contrasting with a 3 percent increase in the first half of fiscal year 2026.

Outlook

The Indian government is working out measures to boost iron ore production and address the under-utilisation or non-operationalisation of mines. These include stricter timelines, specific milestone-based timelines for mining leases and composite licences, enhanced performance security mechanisms, online transparency measures, and restrictions on exports. It is expected that iron ore production will increase in the second half if these reforms are implemented.

Additionally, industry associations have also highlighted the divergence between firm iron ore prices and the downtrend in steel pricing, which has pressured margins. Notably, only one virgin mine has started production in the last 11 years of the auction regime, cited the Chhattisgarh Sponge Iron Manufacturers Association. In a recent letter to the Indian mines ministry, the consortium has recommended export duties, a review of the current auction model, and mining incentives to boost domestic availability of iron ore.

Source: BigMint