International credit ratings agency Fitch Ratings has announced that it expects a modest recovery in the global steel market in 2026, maintaining a neutral outlook for the sector. According to Fitch, weaker steel consumption in China will be broadly offset by rebounding demand in other regions.

Supportive factors include easing monetary policy, continued infrastructure investment, and a gradual recovery in construction activity. However, Fitch cautioned that the pace of recovery remains exposed to risks stemming from geopolitical uncertainty, subdued demand in certain manufacturing segments, and persistent global trade tensions.

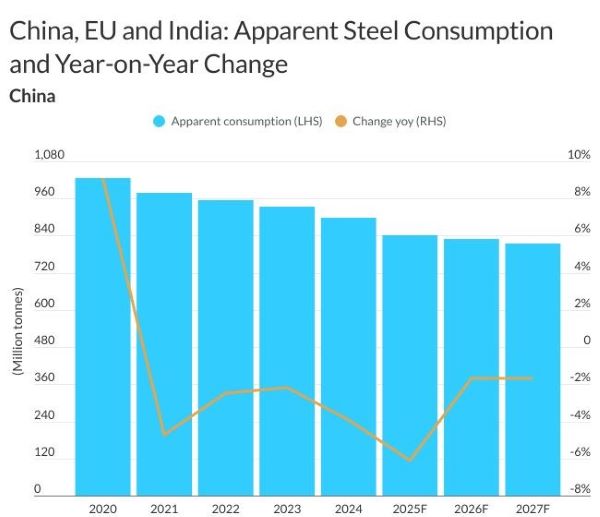

China: lower output and exports expected

In China, Fitch forecasts steel output to decline by around 4.5 percent in 2026, reflecting tighter production controls and the impact of rising trade barriers.

As a result, Chinese steel exports are expected to fall from an estimated 118 million mt in 2025 to 109 million mt in 2026, according to Fitch’s Global Steel Outlook 2026. Despite lower output and exports, Chinese steelmakers’ margins improved in 2025 and are expected to strengthen further in 2026, supported by efficiency gains and declining cost pressures.

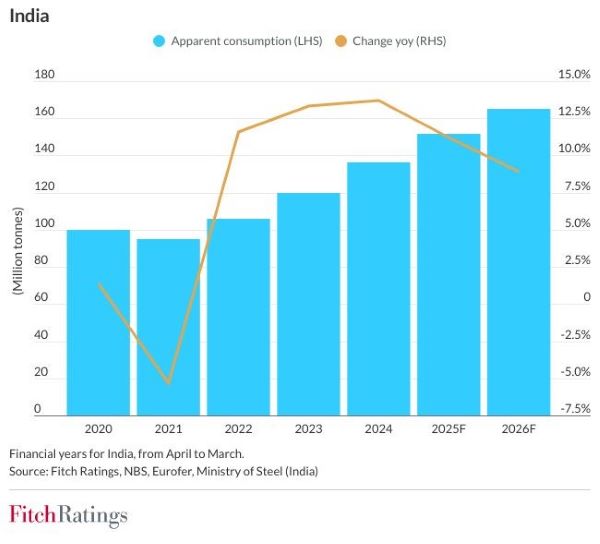

India to remain a key growth driver

India is expected to remain one of the main growth engines for the global steel industry. Fitch noted that momentum will continue to be underpinned by sustained government spending and policy measures supporting national infrastructure programs, urban housing development and industrial corridors.

Recent adjustments to the goods and services tax are also expected to reinforce demand from major end-use sectors, helping to partially offset the negative impact of international tariffs. However, Fitch identifies rising steel imports as the main risk to domestic producers’ profitability.

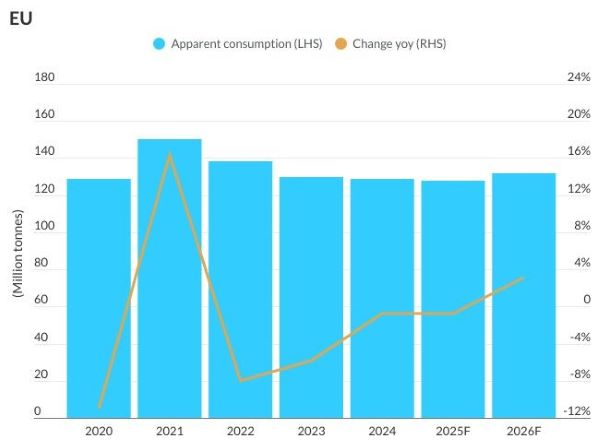

Europe: import controls and CBAM to support margins

In Europe, Fitch expects tighter import controls and the gradual implementation of a carbon tariff on imports to support steelmakers’ margins, while increased infrastructure and defense spending should help drive a recovery in demand.

The agency points to measures presented by the European Commission that are likely to take effect from July 2026, including a tightening of import quotas by around 47 percent to 18 million mt per year, a doubling of out-of-quota tariffs to 50 percent, stricter controls on steel origin, and the discontinuation of quota rollovers. In parallel, the introduction of the Carbon Border Adjustment Mechanism (CBAM) from 2026 will progressively raise carbon-related costs for imported steel.

US: infrastructure and policy support demand

In the US, Fitch expects infrastructure investment, an improving demand environment, lower interest rates and limited import pressure to support domestic steel producers.

Steel demand is forecast to grow at a low single-digit rate in 2026 compared with 2025, supported by the Infrastructure Investment and Jobs Act, the Inflation Reduction Act and the CHIPS Act, as well as a recovery in construction and automotive demand following a weak 2025.