US scrap prices have been on a slight incline since May due to lack of scrap availability, and in July, the tight supplies in combination with a pick-up in US mill purchases caused US busheling prices to take their biggest leap of the year so far.

SteelOrbis has been tracking US scrap prices very closely and reported on a June increase before other publications reflected the new transaction prices. To recap, after US domestic scrap prices increased by about $43 /long ton ($42 /mt) in the first week of May and by another approximately $10 /long ton in early June (see SteelOrbis' June15 2009 report ). SteelOrbis also predicted a strong increase by late June (see SteelOrbis' June 29 report ) and the prices have continued to rise in July.

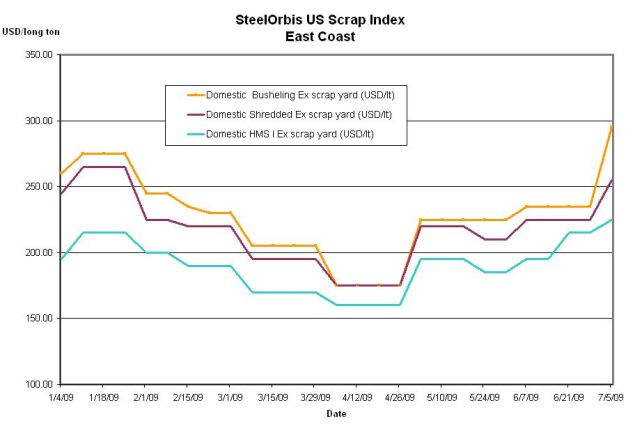

When compared to the prices reported by SteelOrbis at the beginning of June, US busheling scrap prices have gone up significantly, by around $60 /lt ($59 /mt) on the East Coast, and by as much as $95 /lt ($94 /mt) in the Midwest, while both shredded scrap prices and HMS I prices have risen by about $30 /lt ($30 /mt) in most of the country.

Currently, on the East Coast, US domestic busheling prices are in the range of $290 to $300 /lt ($285 to $295 /mt); shredded scrap prices are between $250 to $260 /lt ($246 to $256 /mt); and HMS I prices at a level of $220 to $230 /lt ($217 to $226 /mt).

The price increases are largely due to a shortage of scrap supply in the market, particularly of prime grade scrap. In addition, the recent price increases in the US flat rolled market have allowed US scrap prices to go up as well. With the limited scrap supply in the market and low scrap inventories amongst the domestic mills, producers have increased their scrap purchases to secure/replenish their scrap inventories in order to continue or even slightly increase their levels of production.

Mills in the auto-centric cities like Detroit, Cleveland and Chicago have seen the largest drop-offs in prime grade scrap availability, and it will be a while before US automotive production returns to normal levels. The shortage of industrial scrap has even caused a reemergence of scrap imports from Europe.

Meanwhile, the US market for another raw material, pig iron, has also picked up along with the domestic scrap market. As there is shortage of scrap supply, some domestic mills are turning to pig iron to help feed their production. However, pig iron supply in Brazil is still low as most of the pig iron mills remain closed. Therefore, Brazilian pig iron prices have been pushed to the level of $320 /mt CFR Nola, which reflects an increase of approximately $40 /mt from a month ago.